Three Things for March 24, 2022

This week: Public Radio and the challenge for new donors. Plus, understanding the “Post-Technology” generation and The Infinite Dial 2022.

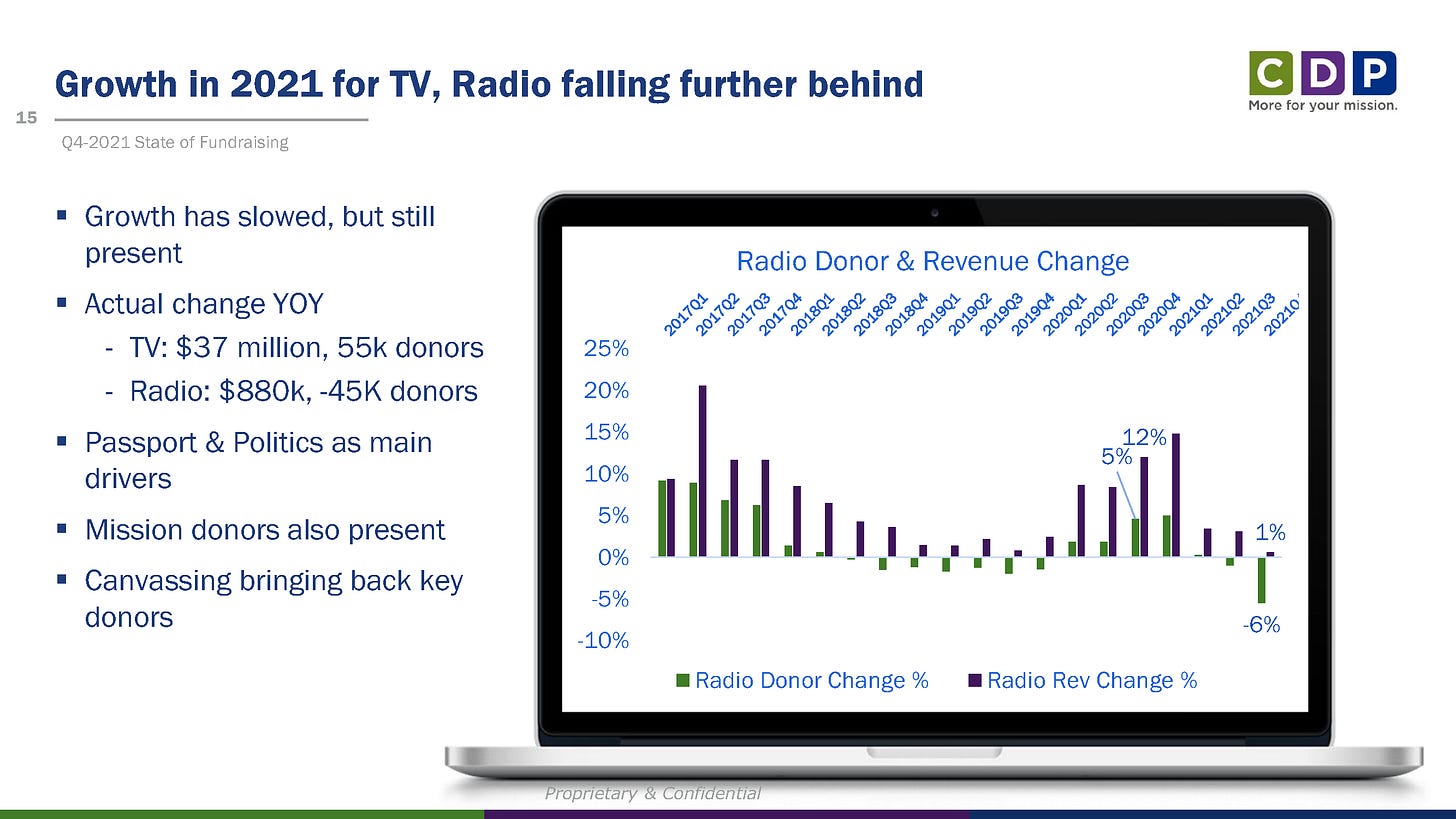

THING ONE: The State of the System 2021 — Radio is Falling Further Behind

Last week, the Contributor Development Partnership (CDP) hosted a webinar that looked at the state of individual giving to public radio and television through the end of the 2021 calendar year.

CDP President Michal Heiplik, Daren Winckel, CDP’s Senior Director of Fundraising Strategy, and CDP’s Chief Customer Officer, Stephanie Patterson, provided a deep dive into the data from the National Reference File (NRF) of 187 stations that includes 90% of all public television donors and over 50% of public radio donors.

This is the most extensive collection of data on public media’s contributors, more than 4.3 million donors. Plus, the information from CDP’s analytics is timely, allowing stations to quickly turn the information and trends from the reports into short-term tactics and long-term strategies.

The session opened with an environmental scan on the economy and the nonprofit sector. We looked at many of these issues in the February 10 edition of Three Things. The Chronicle of Philanthropy’s Dan Parks also writes monthly on the economy’s impact on the nonprofit sector. The headline from his piece from March 15 was “Economic Data Shocks Charity Officials Just as They Were Hoping for a Post-Pandemic Boom.”

Turning now to the fundraising performance of public media, the results were a mixed bag with more good news for public television than for public radio.

Public Television is still riding the wave with PBS Passport with a YoY revenue increase of 8% in the Q4 of 2021 with a two percent increase in donors. Meanwhile, as the chart above shows, public radio saw a six percent YoY decrease in donors, 45,000 fewer contributors, and only a marginal increase (1% and less than $1 million) in revenue.

But if there is a headline from this session that would get your attention, it would be from the slide below. 2020 was a year that donors stepped up in a big way to support public media because of the news cycle, and, for public television, stations saw significant growth in new members signing on through PBS Passport. But unfortunately, this was not the case in 2021 with first-year donors.

Public Radio saw a 32% decrease in the median change in first-year donors in 2021 and a 22% decrease in revenue from first-year donors.

Public Television and joint licensees were also in negative territory (down 8.5% in first-year donors and -3.3% in revenue), but not nearly as significant as public radio.

In sharing these results, CDP’s Michal Heiplik described the -32% as “really alarming.” He adds that coming off the big gains in 2020, a drop is not unexpected; however, a decline of this significance is “not normal.”

The CDP team pointed to some of the reasons for this drop-off:

First, on-air pledge is not holding up for radio. It’s not doing particularly well for television either. Still, public television has been able to bring in new donors from other sources like PBS Passport, and many stations are now doing canvassing as an acquisition channel that’s working well.

There’s been no significant digital strategy to acquire new donors to public radio.

Local engagement by public radio stations doesn’t seem to be converting audiences to giving - at least not enough giving from first-time donors to keep pace with attrition at stations1.

There’s a significant need for public radio to diversify its new donor acquisition efforts. This translates to the fact that on-air pledge cannot be the only tool stations use to acquire first-time donors.

What’s more, you can’t equate the drop in audience to this kind of change as a large part of the public radio audience is returning as we move farther away from the lockdown months of 2020.

The chart below from CDP’s Revenue Opportunity and Action Report (ROAR) library shows every public radio station that submitted data to the NRF. The graphic shows that only a few stations are experiencing new donor growth. The green color shows those who have performed the best compared to their peers - even when losing new donors; they lost less. Conversely, every station in yellow and red has fallen behind in acquiring new donors.

The CDP analysis notes that those stations with significant losses are without diverse acquisition channels for new members. By the amount of red you see on the graphic, that’s a lot of stations. As noted previously in Three Things, not enough new donors are joining public radio stations to outpace attrition.

Another interesting comparison between public radio and public television was looking at revenue per donor. Public radio saw a big jump in revenue per donor, from $187 in Q4 of 2020 to $198 in Q4 of 2021. Meanwhile, public television stations’ revenue per donor dropped in that same period from $158 to $131.

The reality is that public radio is bringing in more money from fewer donors while it’s just the opposite for public TV: more donors giving less money. Public radio’s existing donors, primarily sustainers, are driving up the value of their giving to stations, which is a very good thing. However, the lack of new donors that typically give less with their first-time gift is driving that number up.

A primary reason for these results on the TV side is the entry-level for PBS Passport is an annual gift of $60 ($5/month).

The webinar then turned to revenue retention, which is one of those metrics with long-term implications for stations’ individual giving efforts. As the headline on the graphic below notes, this is where things get scary for public radio.

First, in overall revenue retention, you can view the graphic here; there was a sharp decline for public radio from a year ago with an 8-point drop from 95% IN Q1 of 2021 to 87% in Q4 of 20212. The reason for this was a decline in online and on-air donors. This kind of decrease is a trend you don’t want to see with a healthy individual giving program.

The chart above looks at the retention of first-year donors to public radio, dropping from 54% to 49%. This is even more worrisome because it indicates that first-year donors, at least those who gave in 2020, are not as loyal as we’ve seen in the past.

CDP’s Daren Winckel added that the first-year retention issue seems to be more related to one-time as opposed to monthly donors. However, the number of sustainers is down from previous years. This may not be a surprise in that many donors may have given for the first time during the nonstop 2020 news cycle and chose to not come back the following year3.

There was some positive news from the webinar for public radio stations.

For public radio, monthly giving (i.e. sustaining membership) efforts are really paying off for stations. Monthly donors now make up 62% of the member files in public radio with 50% of all individual giving revenue (up from 45% in 2020) now coming from sustaining donors.

Another positive is growth in donors giving $1,000 or more4 to stations. Overall, public media stations increased the number of $1K donors by 6.4%, resulting in a 13.2% increase in revenue from donors giving $1,000 or more. Public radio increased $1K donors by two percent with a seven percent increase in revenue. The CDP team adds that this increase can be attributed to technical enhancements through improved prospect research and the professional development of existing major giving staff at stations.

CDP’s Stephanie Patterson also says that there is a wide variance in station performance regarding their $1K giving programs. For example, some stations are doing well in adding and retaining $1,000 donors, but there seems to be no significant retention strategy for 50% of the stations that submit data to the NRF.

The biggest opportunity in public media is growing gifts of $1,000 or more with over $100 million in annual revenue possible by improved performance in this area.

Given this presentation’s trends, public radio faces a major challenge regarding its most important and reliable revenue source. The issue regarding the decrease in first-time donors is not just a development or membership department problem. This is an issue that needs the attention of leadership across the organization.

There’s the audience development opportunity5 to build the loyalty of new and existing listeners and readers through a station’s digital channels.

We need to become habit-forming for our audiences with newsletters, social media engagement, websites, streams, and podcasts. Just as we look at listening occasions using Nielsen Audio data for our broadcast service, we need to be focused on how often audiences are returning to our digital content as a critical KPI to create the pipeline for those first-time contributors.

As was discussed in the webinar, it’s vital to create more acquisition channels to attract new donors. Perhaps it’s through canvassing or the opportunities that might exist with NPR’s upcoming podcast bundle concept that member stations might be able to take advantage of in a fashion similar to PBS Passport.

Where do you see the opportunities to increase first-time donors at your station? Please share your comments.

I also hope that Greater Public will use this moment and devote a significant portion of the agenda at this summer’s PMDMC to addressing this challenge.

THING TWO: Understanding the “Post-Technology” Generation

Newly released research from the marketing tech firm CM Group offers a fascinating look at the motivations, behaviors, and preferences of Gen Z, an audience that public media will need to be reaching very soon if it intends on staying relevant in the years ahead.

The CM Group recently partnered with F’inn, an innovation agency that combines design thinking with user-centric insights, on a cross-generational survey of more than 1,000 consumers6. A panel of retail and media experts analyzed the results, formulating a report that reveals just how different this age demographic is from their older counterparts.

While this newsletter has shared previous insights into this demographic, this study points to the need for organizations to think very differently in how they seek to approach, engage, and maintain the loyalty of this group born between 1997 and 2012.

One of the initial stories found in this study is the impact of the past two years on Gen Z.

A study released in December 20217 found the pandemic as a source of stress that continues to interfere with social lives, educational and career goals, and their wellbeing. Overall, 35% of Gen Z frequently experience anxiety, while 46% report experiencing it sometimes. Uncertainty about the pandemic and fear of infection are among the top sources of stress for this generation, comparable to finances, body image, and family or personal relationships.

With this in mind, the CM Group research points to how this generation uses media and technology and how they make purchases and define their expectations as a consumer.

Let’s start with media habits and news.

Gen Z is more likely than other generations to rely on social media and influencers to stay informed.

“Video is a key format for Gen Z since they’re socialized to video (i.e., TikTok, TikTok and more TikTok), and it’s an immersive way for publishers to deliver messages with their marketing clients,” says Kerry Twibell, a former media executive who has worked at MediaLink, Hearst, Conde Nast, Newsweek, and News Corp.

The study also found that Gen Z, since access to technology has been a part of their lives from the beginning, means that they’re more comfortable than older peers in taking what they want from tech and leaving what they don’t need.

For example, 22% of Gen Z have used Apple Pay in the last six months compared to 13% of Millennials, 11% of Gen X, and 5% of Boomers. They also rank their online privacy as less important to them than other generations.

They’re not about to marry a robot and never leave their rooms. In fact, they like in-person social interaction and shopping, and they aren’t afraid to ditch technology for a better experience “IRL.” The excitement and idealism that has colored digital growth and new technology in the past are fading, as is the danger of misinformation and misperception. In a sense, Gen Z and younger millennials have “mastered” technology. They use it to suit their convenience, and they’re appropriately skeptical about tech capabilities and company motivations.

The research also found interesting distinctions between Gen Z members who identify as male versus those who identify as female.

Gen Z males tend to be more altruistic than females (24% vs. 10%).

Gen Z females are more likely to shop in person than their male counterparts (52% vs. 33%), and they’re also more likely to patronize local and small businesses (32% vs. 17%).

Gen Z males and females love YouTube equally, but females favor TikTok, Snapchat, and Pinterest, while males prefer Twitter and Instagram.

Gen Z females prefer to interact with companies via email more than males (36% vs. 26%). When there’s a problem, females are more likely to pick up the phone and call a company, whereas males are more likely to turn to an online search.

The report offered ten takeaways from the experts who analyzed the research, and here are a few that public media needs to be thinking about as it seeks to attract these young audiences to our services:

Personalization is everything. Gen Z is willing to exchange personal information for good experiences, but that means brands need to tap into the latest technologies to ensure that it’s not just their marketing messages that deliver value. This is an area where, in general, public media needs to step up its game, and we can’t wait around to bring a more personalized experience to young audiences.

Companies must adopt technologies that enable them to move at the speed of the customer. If we’re serious about reaching Gen Z, Tik Tok and YouTube are the places to be and ensure that Apple Pay is a payment option on our donation pages.

Media brands must take a stand. “This generation is interested not only in the type of coverage or content a media organization provides, but also how they’re acting on it,” says Allison Mezzafonte, a former media executive who has worked at Bauer Media, DotDash, Hearst, AOL, and Elle Decor. “This can include a reduction in a media organization’s carbon footprint via a remote workforce, as well as its actions on diversity, equity, and inclusion. Make no mistake: Gen Z is paying attention to these things.”

Companies need to think of media in terms of voices versus outlets. This is a generation that puts a lot of stock into the recommendations of influencers. So how can public media serve as a tastemaker for Gen Z as their idea of trust in media is shifting to voices even more than brands and media outlets?

Be prepared for subscription saturation. Gen Z embraces subscription models, which fits nicely into our sustaining membership programs. However, public media needs to evaluate its language around monthly giving to fit the needs of Gen Z’ers. I recommend this post from Vindicia, which works with the corporate sector to grow subscriptions and recurring revenue. This post about “Trust and Subscriptions” has a lot of applications for how public media should market monthly giving, particularly to younger donors.

Position yourself for the Metaverse. I personally still can’t quite figure out what this means exactly, but there is no doubt in my mind that Gen Z is far more willing to embrace augmented and virtual reality options when it comes to daily experiences. If public media wants to be a part of their lives, we have to go on this journey with them.

If you’re interested in reading the full report, you can find it here. It’s worth checking out.

THING THREE: A Quick Summary of The Infinite Dial 2022

Yesterday, Edison Research revealed The Infinite Dial 2022 study, the latest research in digital audio, social media, mobile, smart speakers, and podcast consumption.

The study revealed that Seventy-three percent of the U.S. 12+ population (an estimated 209 million people) have listened to online audio in the last month, up from 68% in 2021. This jump was primarily driven by listeners age 35+, as the number of 35+ who listen to online audio monthly increased by 13% year over year.

In addition, weekly online audio listening rose to 67% of the U.S. 12+ population, up from 62% in 2021.

One of the data points I was interested in seeing in this year’s research is the overlap of in-home radio ownership with smart speaker ownership.

The chart above trends this over two-year increments since 2018. The idea here is the hypothesis that many consumers are replacing an in-home radio with a smart speaker, and the research would tend to support that assumption.

At a time when the percentage of households with radios fell from 71% in 2018 to 61% in 2022, smart speaker ownership grew from 18% to 35% during the same time period. The result of this is that households that own neither a radio nor a smart speaker fell only slightly from 24% in 2018 to one in four in 2022.

While a smart speaker owner has a virtually infinite number of audio choices versus AM/FM radio, these devices keep the listening opportunity available in the home, which is a huge deal.

As I predicted in Monday’s Three Things Datebook, there was a significant slowdown in smart speaker adoption in 2022, with only six percent growth in household ownership after sizable double-digit increases in prior years.

There’s a lot more to unpack from this year’s study that we’ll look at in future editions of Three Things. But we’re out of space for this week.

Don’t forget about the Zoom session that the Public Impact Group is hosting on Thursday, March 31, 2022, at 4:00 pm (Eastern) on Public Media and “The Great Resignation.”

Please join your public media colleagues for a 60-minute dialogue about ideas and potential solutions to help public media organizations surmount this challenge and thrive in the months and years ahead.

You can register at this link, and you'll be receiving an email with details about participating in this Zoom session on March 31. Thanks.

This does not mean that stations should stop focusing on local engagement. What it does mean is that we need to develop a donor acquisition strategy that links to these engagement efforts.

During the webinar, Michal Heiplik rightly pointed out that most nonprofits would kill for 87% donor retention.

A few weeks ago, in the Three Things Datebook, I mentioned The Chronicle of Philanthropy webinar on “How to Retain Donors Who Gave During Crises.”

CDP describes $1,000 donors as “major donors” for benchmark purposes only. However, they recognize, as do I, that a “major donor” in most nonprofit circles is typically a donor giving $10,000 or $25,000 annually.

I’ll have more on the idea of Audience Development coming on Monday in the Three Things Datebook.

Methodology: The purpose of this research, undertaken by CM Group in partnership with F’inn, was to gather insights into the consumer outlook for the next five years. For this study, we conducted 15-minute online quantitative surveys with more than 1,000 U.S. consumers, across all generations, between Sept. 30 and Oct. 7, 2021.

AP-NORC Center for Public Affairs Research. (December 2021). “Gen Z and the Toll of the Pandemic”