Three Things for February 10, 2022

This week: Some early warning signs for nonprofits including the challenges of filling vacancies during the "Great Resignation." Plus, YouGov’s 2022 Media Consumption Study and two newsletter nuggets

THING ONE: Some Early Warning Signs for Nonprofits

What a difference a month makes.

As 2021 ended, there was a lot of optimism in the nonprofit sector about the year ahead, with a booming stock market signaling a robust atmosphere for philanthropy into 2022. A few weeks ago in Three Things, I wrote about Jessica Browning’s forecast for 2022, with the first bullet point being “Nonprofits ride the bull market.” Browning is a consultant with the Winkler Group, and she suggested a banner year for nonprofits based on the belief that the stock market would continue to climb in 2022.

Then January arrived and offered the one-two punch of a declining stock market and rising inflation coupled with a tight labor market resulting in increased operational expenses for many organizations.

The Chronicle of Philanthropy has been doing monthly updates to assess important economic trends and their impact on nonprofits over the past year.

The nervousness coming out of January was reflected in a survey of attendees to the CDP “Radio Roundtable” webinar last month about the National Reference File and the trends between increased membership revenue but a lack of new donors.

The question asked was: Are you optimistic in surpassing your donor count goal this calendar year?

And the responses above showed nearly two-thirds were either not optimistic or neutral about whether they would surpass their donor count at their station this year.

That’s a lot of folks worried about the coming year.

The piece in The Chronicle noted the plunge of the S&P 500 that saw huge fluctuation in the market throughout the month. This type of activity will surely cause some anxiety among moderate to high wealth individuals and their willingness to make significant donations to the nonprofit sector.

Perhaps a bigger concern for public media is a decline in consumer confidence that also occurred in January. The University of Michigan’s Surveys of Consumers fell 4.8% month over month and a whopping 14.9% YoY last month. The researchers at U of M noted the combination of the Omicron variant and inflation fears were the drivers behind this concern from Americans over the state of the economy.

“The danger is that consumers may overreact to these tiny nudges, especially given the uncertainties about the coronavirus and other heightened geopolitical risks.”

Coincidentally, NPR’s Asma Khalid had an excellent report on Tuesday exploring this very subject.

The Chronicle also noted the two-sided issue of rising wages, which is good for workers but also presents challenges to nonprofit employers to either keep up or risk losing staff.

In a December 2021 post, The Conference Board, a membership organization for small businesses, projects that trend will continue in 2022, with wages rising another 3.9%.

Since public media is such a people-driven industry, this adds to the challenge for stations and networks, particularly when there are growing opportunities with competitors outside of public media for talent, whether it’s on the content, technology, or revenue side.

The challenge of retaining staff and filling positions is not unique to public media and is happening across the nonprofit sector (and in the private sector as well).

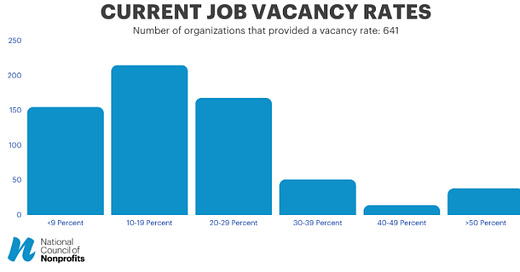

The National Council of Nonprofits released the results of a survey in December 2021 that found that four in ten nonprofits were struggling with job vacancy rates of 20% or more.

Eight out of ten nonprofits identified salary competition as a factor preventing them from filling job openings.

How is your organization doing in terms of filling positions?

This is a critical issue for public media organizations, but we really don’t know how good or bad it is across the system.

To help learn more about this challenge facing stations and networks, please complete this very short survey to help us get a better sense of the talent shortage across public media.

I’ll share the results in an upcoming edition of the Three Things newsletter.

For stations, will the inflation issue also come into play regarding programming fees from national distributors in the coming fiscal year?

The NPR newsmagazine fee structure tied to membership revenue will hopefully not be adjusted due to increased network costs that include the new NPR | SAG-AFTRA contract approved in the fall of 2021. The new agreement will bring annual 2.5% raises through 2025 for NPR’s audio and digital public media professionals. This is well below that 3.9% trend mentioned earlier in the Conference Board study

But how will rising costs, be it for programs, labor, or other services, impact stations that need to be investing as much as possible into content, audience development, and revenue-generating activities?

These challenges may require a different approach for organizations struggling to do all the things needed to serve audiences and raise the funds needed to provide those services.

I’ve frequently written in this newsletter about how stations may need to look at the scale of there operations and find opportunities to collaborate or redeploy resources to others who can manage certain aspects perhaps as good, or better, than keeping those activities “in-house.”

One thought for public radio that I would love to see would resemble the Programming Service for Public Television, albeit it would have to be much more diverse in its staffing.

CDP and Greater Public provide excellent resources on the development and membership side of the equation. Market Enginuity handles underwriting and sponsorships for at least fifteen public media organizations. This shortlist doesn’t even address the potential ideas around what could be done on the content production side to further what’s already happening collaboratively with stations across the country.

What ideas do you have to “work smarter, not harder” at your organization? Please leave a comment, and let’s work on this together.

THING TWO: YouGov’s 2022 Media Consumption Study is All About Digital

I find the polling work of the market research and data analytics firm YouGov as some of the best and most accessible information about everything from politics to technology and the economy to “What men and women really want as gifts for Valentine’s Day 20221”

So when an email pops into my inbox with a link to YouGov’s Global Media outlook report 2022, I had to dive right in and take a look. The research covered 17 global markets, with more than 19,000 people responding to the survey that was in the field in October and November 2021.

The report provides a global perspective and breaks down the data by country with a lot of focus on the U.S. and Great Britain.

If you were to write the lede for this study, it’s that the top growth drivers of media consumption in the next 12 months are all digital. Video streaming leads the way, with podcasting growing quickly.

The report also discusses news sources for U.S. audiences and reveals that, to no one’s surprise, the proportion of adults consuming news increased marginally from 93% in 2019 to 94% in 2020 fuelled by both the pandemic and the presidential election, and then dropped back to pre-pandemic levels in 2021.

Another major takeaway was that while overall news consumption penetrations have remained steadily high over the last three years, traditional media sources (TV, radio, and print) have experienced a consistent decline, suggesting a gradual shift to digital news sources.

Most digital news sources increased penetration between 2019 and 2020, and then dropped to pre-pandemic levels in 2021, except for podcasts which have continued to grow in popularity. In 2021, social networks and newspaper websites (in second and third place) are almost at equal levels with a third of Americans using them for their source of news.

From the global research, 95% of all adults globally claimed to have visited websites/apps in the last year, and a similar proportion intend to use websites/apps in the next 12 months.

Radio drops slightly from last year to this year, hovering right around 80% of adults globally. However, podcast usage is expected to increase slightly globally, with about 60% of all adults intending to listen to podcasts in the coming 12 months.

One of the interesting ideas presented in this study is a series of consumer metrics that YouGov has created to help profile and quantify where growth will come from and which media types are likely to “stick” in the next 12 months.

Stickiness: Those who claim to have maintained or increased their consumption of each media type in the last 12 months, and are likely to maintain or consume more in the next 12 months.

The chart above is good news for radio. Here’s how the researchers describe the story of radio from 2021 to 2022.

Radio is a media of habit, and listening often revolves around routines, for example, listening to the radio in the car on the way to work. The pandemic disrupted many work and lifestyle routines in 2020, which has in turn impacted media consumption.

Whilst radio registered the highest proportion of consumers globally who claimed to reduce their consumption last year, those who stuck with radio consumption appear they will remain loyal in 2022, with 91% intending to stick with radio in the next 12 months.

Another term used by the researchers is the idea of Growth Drivers.

That is, those who claim to have maintained or increased their consumption of each media type in the last 12 months and are likely to do more in the next 12 months.

And this is where digital media shows its strength from a consumption standpoint.

More than a third (36%) of those who either maintained or increased their video streaming activity in the last 12 months are likely to increase their use of video streaming services in the next 12 months.

Streaming music followed, with 32% who streamed more or the same amount of music in the last year are likely to increase their streaming activity in the next 12 months. Social media and websites/apps were in joint third position with a growth driver score of 31%.

Meanwhile, More traditional media forms (radio, newspapers or magazines, and TV) are experiencing lower projected consumption growth among those who claimed to have consumed more or the same amount of each media in the last 12 months.

The study of U.S. consumers found that live TV is still king with older audiences. However, those between 45 and 54 have similar on-demand TV penetrations to those between 18 and 24. In addition, the data shows a clear digital divide between the under 55s and those aged 55+.

The study also looked at social media consumption in the U.S. and supports the considerable growth in users of TikTok that we’ve seen in other research studies. The YouGov research also sees strong YoY growth for YouTube that significantly outpaced other social networks. The expansion of TikTok and YouTube are both driven by Gen Z.

One other piece of data of value for the radio industry came from the question to U.S. consumers: “Which of the following do you normally use to listen to music?”

72% of those between 18-24 said online radio or streaming, with 49% saying radio. In addition, 70% use their mobile phone to listen to music.

By comparison, 72% of those 55+ use radio, with 42% saying online radio or streaming. And 10% of them are still using cassettes!!

A couple of other quick takes from the research:

Print readership continues to be challenged. Weekly print newspaper readership dropped considerably from 32% to 19% in 2020, although readership penetrations leveled in 2021. Weekly print magazine readership followed a similar trend to newspapers, with weekly penetrations falling from 19% in 2019 to 11% in 2020 and stabilizing in 2021.

YouGov data reveals that 30% of consumers intend to listen to podcasts more in the coming year. As a result, podcasts present a substantial opportunity for brands and advertisers to engage with a highly receptive and engaged set of listeners, particularly younger generations.

Media consumption will be leveling out in the year ahead. Despite the pandemic, YouGov global data identify a high proportion of global consumers who are planning to stick with their media choices in the coming 12 months. Whereas COVID-19 fuelled a surge in media consumption over the last 12 months, and in the coming 12 months, the data suggests a ‘leveling out’ in overall consumption.

The full report runs more than 50 pages and is full of fascinating information. You can get access to it all through this link.

THING THREE: Two Newsletter Nuggets

Frequent readers of Three Things know that I’m a huge fan of the daily newsletter as a way to reach new and existing audiences with a personal connection similar to our broadcast product.

I’m delighted to see more public radio outlets committing to producing a news product delivered to inboxes on a daily basis. This is becoming a very competitive space nationally and increasingly on the local level.

Last week, TechCrunch reported that Apple News is jumping into this space with its first daily local newsletter, with the San Francisco area being the jumping-off location for this new product.

For public media, the good news is that KQED will be among the outlets where stories will be curated for what is being described as “a local’s end-of-day digest that includes notable news and other information about what’s happening around them.”

That said, the Apple newsletter will be competing directly against KQED’s own newsletter.

What makes Apple’s move into this space compelling is that the newsletter’s content will not be dependent on algorithms. Instead, Apple News editors will curate the product as they do with their enhanced local news coverage.

Currently, Apple News provides local news coverage in San Francisco and ten other markets across the U.S., including New York, Houston, Los Angeles, San Diego, Sacramento, Miami, Charlotte, San Antonio, and Washington, D.C. The TechCrunch post reports that it plans to launch its local news feature in more cities in the coming months.

Meanwhile, I’ve been following the growth of Axios Local since I started publishing this newsletter last spring. They are in 14 markets and looking to expand to 11 soon.

As a former resident of Columbus, Ohio, I’ve been reading the Axios Columbus product since it debuted in the fall to get a sense of the product’s strength in covering the region. I’m also interested in what’s going on in Columbus as I still have a daughter living there.

Axios has been talking about establishing a membership program for readers, and they made their first pitch to folks in Columbus last week.

Being curious about what being a member of Axios Columbus might consist of, I took the bait and clicked on the link to learn more.

The membership page is pretty basic, and the ask is to join with a one-time annual payment of either $50, $100, $250 every six months, or $500. I’m very surprised that they aren’t adopting a monthly payment model and even more surprised by the limited perks they offer to members.

I also find the last sentence (below) kind of funny as a disclaimer.

In addition, the payment system is clunky and probably leads to most people not completing the transaction.

I’m actually surprised that as well-thought-out most of Axios’ strategies have been with their move to local, this one is really not ready for prime time.

I’m sure this will improve over time, but I can’t imagine that membership in Axios Local will generate much revenue or buzz right now.

There’s no doubt though that newsletters are proving to be an excellent funnel for memberships or paid subscriptions for news organizations. In August, David Tvrdon did a good piece in the trade publication The Fix on the varied strategies that newsrooms are taking to build revenue from newsletter audiences. I suggest you check it out.

A reminder to please participate in our survey on your organization’s current staffing vacancy percentage. If you’re not sure of the percentage yourself, please share the link to the survey with your HR office.

We’ll keep your individual responses confidential and will share results from the survey in an upcoming edition of the Three Things newsletter.

Thanks for reading.

Yes! That was a poll. Spoiler alert: The most common answer among Americans was a card, at 30%.