Three Things for January 9, 2023

For this edition of Three Things we suggest several questions that public media leaders should be asking for the New Year.

As we head into the second week of the New Year, you’ve made your way through the pile of emails from the holidays and are ready to focus on strategy for the coming year.

Since starting my new role with an education-based nonprofit in St. Louis this past April, this newsletter has been relatively silent about the state of the industry. But there is so much going on for station leaders as we enter 2023 that a snapshot look at a few items are worth mentioning, and I hope they are on your radar.

THING ONE: Where Is Listening Headed in the New Year?

Based on a sample of public radio news stations during the fall of 2022, the mid-term elections provided a nice bump for many coming on the heels of a disappointing first three quarters of the year.

In late October, the Radio Research Consortium published a series of slides focusing on AQH listening in 2022 compared to the previous three years.

The report noted the worrisome year-over-year drop in listening from 2021 to 2022 and compared the pre-COVID audience of 2019 with the current year. Overall, listening to radio was down, with public radio news stations in PPM markets experiencing a four percent drop during the months leading up to the mid-term elections.

There was a bit of good news in the RRC report, a return of listening to the weekdays at 7 am hour, which is vital for news stations, coinciding with more people returning to a morning commute.

What isn’t a good sign, though, is that middays retracted during the first three quarters of 2022 compared to 2021. What’s interesting (and problematic) is that this is occurring at the same time that the portion of AM/FM listening continues to grow for station streams versus over the air - and middays are when most streaming occurs during weekdays.

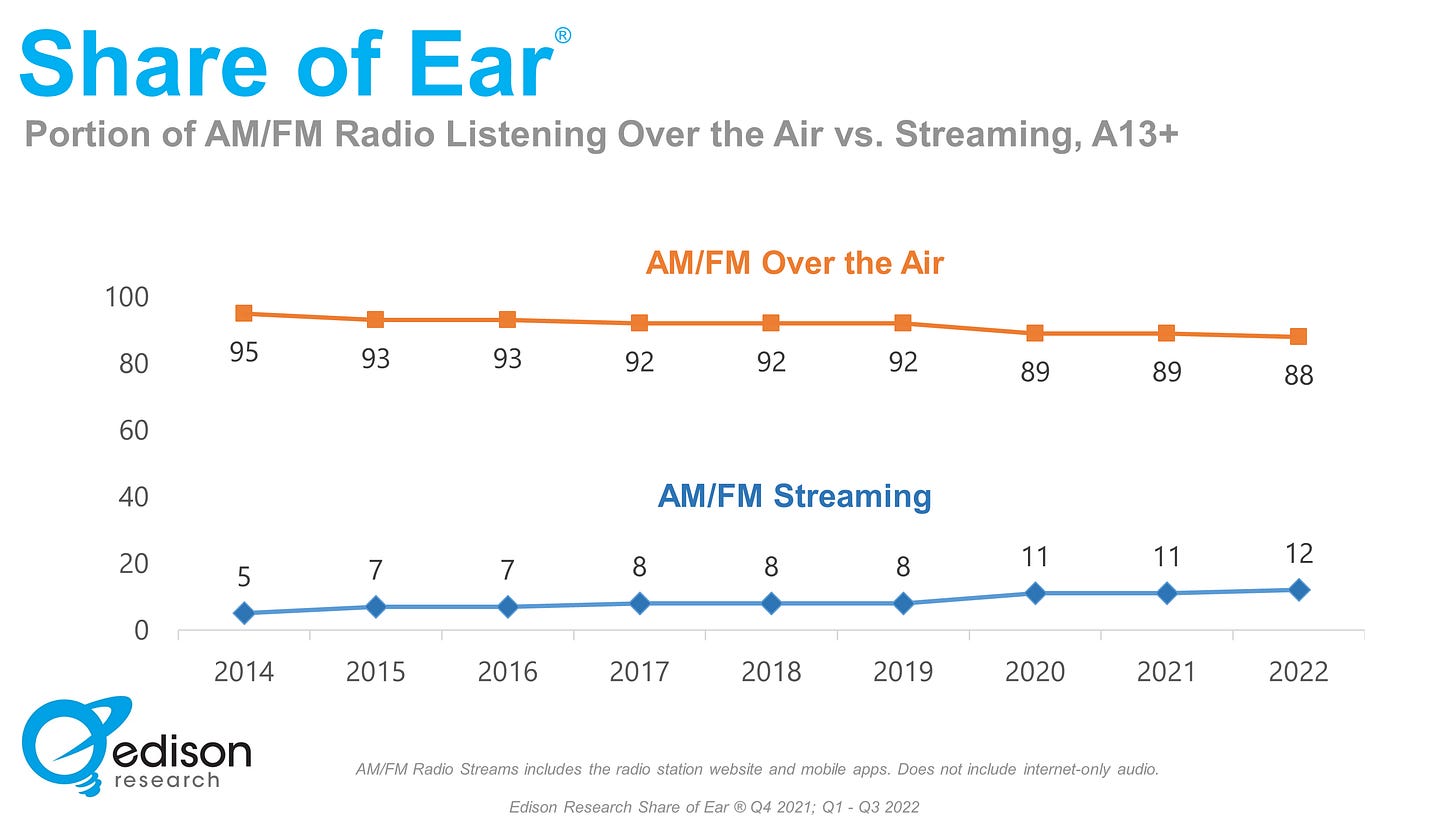

The graphic above is from November’s Edison Research Share of Ear study, which shows annual data from the inception of Share of Ear in 2014.

The comparison only concerns listening to AM/FM radio content – comparing listening on a ‘radio set’ to that done on any streaming device – phone, smart speaker, etc. In 2014, five percent of the total AM/FM listening among those in the U.S. 13+ was to the station streams, with 95% being over the air.

There was almost no change in the share of time with streaming compared with over-the-air listening from 2015 to 2019. In that four-year span, streaming increased by one percentage point. But in one year between 2019 and 2020, the percentage of AM/FM listening time spent with station streams increased from 8% to 11% and is now at 12%

As I noted earlier, there was a nice bump for news stations coinciding with mid-terms in November, as displayed but the RRC graphic below.

But is this increased listening sustainable beyond this short-term bump?

I suggest that it’s probably unlikely as we head into 2023. However, it will be interesting to see the data of listening from the week that just passed as Republicans in the U.S. House of Representatives spent the week trying to elect a new Speaker of the House.1

Public radio news stations usually see a drop in listening in non-election years, bringing a further challenge for stations coming out of the mid-terms.

So the question for station leaders in 2023 is, what will you do to acquire new listeners or increase listening from your current audience this year?

How much attention will you devote to your broadcast service against your website or podcasts?

Do you see your broadcast service as the place where you can grow your audience with younger and more diverse listeners?

How will you distinguish your local service from the national brand of NPR when you may be only producing one hour of original programming a day2, plus newscasts and a few extended features?

And with your radio audience flat or dropping, where’s the money going to come from to do what you need to do with your broadcast services and digital platforms (see Thing Two)?

Finally, how will the increasingly slow growth of smart speakers impact radio listening through these devices, which have been seen as the replacement for radios in the home?

These questions need to be considered as you move forward in 2023.

THING TWO: How will the economy, flat member growth, and the NPR Network impact my bottom line?

It’s hard to believe that this year will mark fifteen years since the Great Recession of 2008 when NPR’s David Folkinflik reported the news that NPR was canceling two daily radio programs — Day to Day and News and Notes — as part of a broader effort by the company to close a projected budget shortfall of $23 million for its 2009 fiscal year.

So the mere coincidence that 14 years later, Folkinflik reported on similar news late last year coming out of NPR HQ that, due to a sharp drop in revenue from sponsors, the company would be forced to severely curtail hiring, amounting to what he described as "close to a total hiring freeze."

The challenges facing media organizations in 2023 due to a flat or declining ad market have been well documented, resulting in layoffs at many news organizations, including CNN and The Washington Post.

A big question at the station level is whether the cuts occurring in advertising at the national level will trickle down locally, and can public radio insulate itself if they do?

Borrell Associates, which tracks local advertising, is projecting basically flat growth in 2023 (+0.6%). Digital forms of ad spending are forecast to grow 5.2% next year, while traditional forms of print, broadcast, outdoor, radio, and cable are collectively forecast to drop 6.5%. Broadcast TV will suffer the largest drop, declining by double digits, according to Borrell3.

“The source of local advertising is local business, and we’re seeing a dramatically different profile caused by businesses that collapsed or shrank and by a record influx of new businesses that replaced them,” said Corey Elliott, executive vice president for local market intelligence. “Anybody trying to forecast 2023 based solely on past trends will have a tough time.”

So corporate sponsorship might be one challenge facing stations in the new year.

Another is the lack of new donors joining public radio and television stations. Michal Heiplik, the President of CDP, has been preaching about this issue for at least the past 18 months and reiterated this worrisome trend in CDP’s Q3 2022 State of System Webinar last month.

Heiplik notes that the strength of sustaining membership programs at many stations has “masked the issue of acquiring new donors.”

For the public radio stations sharing data with CDP, donors are down 7%, with public radio membership revenue down 5%.

The webinar also noted that the median change in first-year donors is down 29%, and the median change in first-year revenue is down 26% for public radio through 2022 Q3.

One of the key points made in the webinar was that public radio is still overly dependent on traditional channels for its membership revenue (mail and pledge). It’s startling that 45% of all donors to public radio are still giving during pledge drives, with most first-year donors still joining through drives.

The CDP webinar also touched on the newest idea to bring new donors to public radio with the NPR Network, a concept first introduced a year ago and approved by the NPR Board of Directors in June 2022. The initiative is designed to grow revenue for public radio, including doubling station membership and network revenue by 2030.

Is this a simple idea? It’s hard to say, but these two slides from a Greater Public webinar last summer attempt to show how it works.

Last month, Current covered the roll-out of the network focused on calendar year-end giving, providing a good summary of the aspirations and worries that this first genuine attempt for NPR to raise small dollar donations directly from listeners in the more than fifty-year history of the company. In addition, last summer, Greater Public hosted several webinars on the NPR Network that are available for viewing on YouTube.

These three factors (the economy, flat donor growth, and the NPR Network) should challenge station leaders in the year ahead to move away from many of our past fundraising models and look at new opportunities to engage audience audiences and grow revenue. Why is this important? It’s because the competitive environment is changing so quickly, and the old ways of doing things will not work anymore, which is what Thing Three is all about.

THING THREE: How Do We Find the People We Need to Meet These Challenges?

Last year around this time, the conversation was all about the Great Resignation. As we begin 2023, attracting and retaining staff continues to be among the highest priorities across all business sectors. In November, McKinsey published a report on “What Matters Most: Six priorities for CEOs in turbulent times.” Among these priorities was to Rebuild the Employee Experience, which includes a piece on The Workplace of the Future.

To get a perspective on where the issues of talent in public media and journalism, I asked a recruiter friend of mine to offer their thoughts on where things stand in the new year.

Below are their comments:

The war for talent is ongoing, but in a (mostly) post-Covid, post-reckoning world, it is even more challenging for public media to compete. Just scan the openings at four or five top stations - openings are going months without being filled.

A few reasons:

A remote workforce, in some form or another, is here to stay. Yes, the PMJA Editor Corps and other similar options for staff-stretched stations addresses the need for remote talent. But reporters, daily show producers, and some station leaders must work in person in YOUR market and, generally, at your station, to be effective. That's tough when the appeal of working in PJs and remotely has so much momentum.

Getting valued, experienced talent to pack up and move requires more time, money, and attention (generally) than before. Moving costs and housing costs make that a key consideration. Your organization might need to become even more comfortable with remote senior leaders.

Pay levels for the demands (perceived or real) and challenges in newsrooms and development jobs are generally too low. My eyeball is, at senior levels, stations can be 20% to 50% below what is competitive - not within the market, but for attracting qualified people to come and stay.

Willing but ready? We are no longer at the plug-and-play stage of hiring, so common for a whole generation of public radio talent. Many new hires in public radio still get assigned a desk, a laptop, a tote bag, and business cards on Day One and are expected to hit the ground running. Those were the old days. Your expectations of your team are higher. And your new potential workforce is eager and hungry to prove themselves, but a whole new generation has NOT climbed the experience ladder. Mentorship is key. Each new hire should be paired with a willing, more experienced mentor to coach them through year one. This is a new step for existing staff and goes far beyond ‘intake.’

There are skills gaps, and there are experience gaps. If you don’t demonstrate a commitment to the success of new team members, you are not meeting the expectations of that new talent. OLD: sink or swim. NEW: Be the swim coach.

And, you can ask for clear results in return from new talent. Setting clear, shared, detailed expectations right away is key to getting the commitment you expect. So many organizations think of their place of work as a factory. Sad, but true. It is not.

There are craft skills and competencies you want to see developed. And expectations around teamwork, ambition, initiative, and leadership.

Force yourself to list specific competencies and goals for the next year. Filter that detail - three goals for one person, maybe five for someone else, down and through the organization. Doing more, trying things, and setting a new benchmark goes beyond what seems like rote tasks. If a job candidate is unwilling to embrace risk, reward, clarity, and responsibility, that person is not your hire.

Career paths. Articulate where someone can go after the first year of excellent performance. That can be growth across teams; project leadership; a training program, a different skilled mentor, and a map to show where people in the organization can go. Stations can become so siloed we barely know what the person down the hall does.

And it just might mean encouraging their growth somewhere at another station.

New generations of talent leave. Make that reality part of the plan.

Audience. Revenue. Talent. Good luck in 2023.

Thanks for reading Three Things.

Unfortunately, NPR did not provide special radio coverage for stations last week, allowing the cable TV networks the opportunity to provide wall-to-wall coverage of this historic week. On the first day of voting on Tuesday, January 3, I turned to WAMU at 1 pm to try to catch the proceedings, and they were carrying Fresh Air.

Paul Jacobs had a great post on the Jacobs Media blog last week asking that question.

This might be primarily due to a non-election year for broadcast TV, coupled with the continued erosion of viewing of broadcast television from TVNewsCheck.

Tim -- Glad you are still paying attention to public radio.

I know I am hopelessly behind the times, but isn't it still true that listener support comes from listener loyalty, the small portion of the population that loves you so much that they send you money when they don't have to. If so, more support comes from more very happy listeners rather than new techniques for prying money from the same number of semi-happy listeners. Almost by definition, focusing on a diverse audience works against developing a super-loyal audience. I am not sure exactly what to do about it, but I think it starts with what you put on the air. Do that correctly, and the money will follow.