Three More Things on the Audiences for Public Radio's News Stations

Was the Major Market Meltdown a Blip? Plus, NPR Member Stations Southern Problem & Rainbows in the Storm.

Thanks to the many readers for their comments and recommendations following last month’s post on the loss of audience of NPR News Stations in the nation’s largest markets.

There has been a lot of activity and discussion over the past month, including the release of the Public Radio Meta-Analysis and the Public Radio Playbook from SRG in collaboration with City Square Associates, Greater Public, and PRPD.

This is excellent work, and stations must focus much of their strategic efforts on utilizing the research and recommendations from the reports. The playbook offers five key takeaways that, in many ways, bring a common-sense approach to a direction that local public radio organizations need to initiate to compete effectively across the modern media landscape.

BRAND. Local public media institutions need to develop their own sense of place, their own community-based grammar, and a genuine sense of intimacy with the communities they serve.

PLATFORM. Traditional linear, broadcast content, delivered via terrestrial radio and live digital streams, cannot be relied upon to reach users who increasingly consume content that is served to them on the digital products they use to be informed, educated, or entertained.

ENGAGEMENT. In a marketplace of more or less homogenous corporate media and AI-driven content delivery, public media has the opportunity to differentiate itself through impactful face-to-face engagement with the communities it serves.

CONTENT. There is an important opening for local public media organizations to complement the nationally distributed content with original content that uniquely reflects and uniquely serves their local communities.

SUSTAINABILITY. A mainly transactional approach to public radio fundraising — which positions the donation as a payment for a service or rewards the giver with a tangible gift—is not sustainable when audiences are not growing, when users have free access to an abundance of content, and those who are philanthropically motivated have not been identified and cultivated.1

Please check out the playbook here.

THING ONE: Was the Major Market Meltdown a Blip?

In last month’s post, I focused primarily on the loss in market share among the stations in the top five markets. The loss was alarming, but additional analysis from the Radio Research Consortium’s Dave Sullivan notes that the drop in Weekly Cume audience could be called a “slow leak.” Dave released a video late last month titled Are Cumes in Crisis? suggesting that Time Spent Listening (TSL) should be “the thing” to focus on to explain current radio trends. Dave notes that the drop in Cume results from new habits formed during the pandemic and that stations need to rebuild the habitual relationship with their listeners.

The video is less than twenty minutes long and is a must-view to understand the trends in listening to radio as a platform and public radio specifically.

The presentation offers some pretty fascinating data. For example:

The Total Market Average Quarter-Hour audience (PUMM%) in most PPM markets in the country is down between 41% and 47% from 2016 to 2023. However, the drop has been negligible since 2020.

The Total Market Average Weekly Cume is only down 0.5% since 2020.

What data shows, though, is that many radio listeners left during COVID and never came back. In 2019, the Total Market Average Weekly Cume in PPM Markets was 139,636,200. In the first half of 2023, it was 125,721,100.

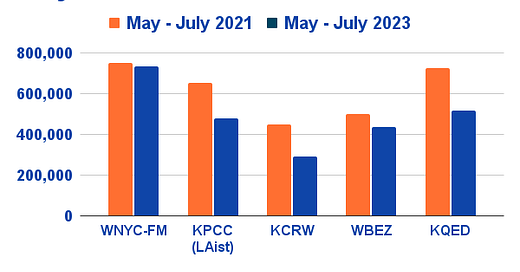

If Weekly Cume has only dropped only a little since COVID, it might be good to look at the Weekly Cume since 2021 for the same five stations2 that we discussed last month. If you recall, we were starting to see a rebound in radio listening in 2021 after the disastrous year of 2020.

The chart below compares the May - July Weekly Cume for the NPR News stations in the top four markets in the country. All stations have seen a drop in Weekly Cume with KQED, and the two LA stations are experiencing the most severe decline among the five stations.

So, to answer the question, Is it a blip? The answer is no.

THING TWO: Does NPR Have a Southern Audience Problem?

In the post last month and Thing One in this edition of Three Things, we focused on the Top four markets in the country. But for Thing Two, I want to discuss the next tier down in Nielsen markets. I’ve long noticed this as it pertains to NPR News stations, and the data tells the story.

What is it about NPR News stations’ inability to reach larger audiences in major markets in the southern part of America?

The 5th and 6th largest Nielsen markets in the country are Dallas-Fort Worth, with a population of 6,339,800, and Houston, with a population of 5,979,700. Atlanta is the 8th largest Nielsen market, with a population of 4,971,100.

All three of the NPR News stations in these markets have stations with good signals, strong leadership, and excellent staff. But when you examine audience data, let’s use Weekly Cume. The most recent six-month average weekly Cume for KERA in Dallas is slightly less than for WHYY in Philadelphia, a market with 1.7 million fewer people.3

Now, there are distinct demographic differences in those two markets. 27% of the population in Dallas is Hispanic, compared to just 9% in Philadelphia, and 21% of Phily’s population is Black, against 17% in Dallas-Fort Worth.

Since education has traditionally been a significant driver in identifying potential public radio listeners, we should also look closely at that data. 38.3% of the D-FW population has a college degree, with 41.9% in Philadelphia,4 which translates into a much larger college-educated population base in the DFW metroplex.

Now let’s look at Houston, where KUHF’s average weekly Cume over the past six months was around 250,000 weekly listeners. This is only slightly more than the average weekly Cume of KPBS in San Diego5, even though Houston has a population of six million compared to less than three million in the 16th largest market in the country.

The one thing that San Diego has going for it, compared to Houston, is that 36.5% of the population has a 4-year college degree compared to 31.3% in Houston. But is that enough of an indicator to inform us as to why KUHF is only reaching 4.2% of the population each week and KPBS is reaching 8.4% of San Diegans?

I don’t think so.

Our final test is in Atlanta, a slightly different market than Dallas and Houston because WABE has an NPR news competitor with Georgia Public Broadcasting. However, if we’re looking at weekly Cume, I don’t think this competition will have that much of an impact.6

Atlanta is the 8th largest market in the country, with a population of just under five million. WABE’s six-month average weekly cume is 267,133, around 5.4% of the market. This is 80,000 fewer weekly listeners than in Philadelphia’s WHYY, a slightly smaller market, and close to the same as KUOW in Seattle, with a million fewer people in Seattle. KUOW is reaching 6.7% of the population in Seattle each week.

36.5% of the population in Atlanta has a 4-year college degree - less than Dallas and more than Houston.

When you compare the three southern stations in the top ten markets, something more than the demographics is at play here.

Without any actual data to back it up, I tend to think that this might be more of the sound of the national shows impacting listening than anything else. The difference in the college audiences in these markets is not significant when weighed against the number of listeners to the stations.

What data there is would suggest that the tone of public radio might work on the coasts and the upper midwest better than in the South? This section from the Public Radio Meta-Analysis indicates that possibility.

One can’t deny that audiences in these three large metropolitan areas are not responding by listening to their NPR news stations in ways that other markets out of the South do. And I think this should be further with research investments to figure it out.

More than 18 years ago, Jeffrey Dvorkin, NPR’s first Ombudsman (now called Public Editor), wrote a column titled, “Why Doesn't NPR Sound More Like the Rest of America?” While the piece has some dated references, it’s worth considering whether this is still true in 2023.

THING THREE: Rainbows in the Storm

We’ve yet to discuss two of the top ten markets in this post (Boston and Washington, DC), and there’s a reason for that.

Many years ago, former Morning Edition EP (later promoted to Executive Editor of News programming at NPR) Ellen McDonnell shared one tactic she always felt was important to include in NPR’s newsmagazine. She said it was always a goal to have at least “one rainbow every half-hour.”

The idea was that the listener needed a beam of sunshine in their news mix to share in the hallway or at the water cooler. The nugget was probably not the day's most important story, but it might be the one thing the listener carries with them for the rest of the day.

To take that analogy to this post, Boston - WBUR, specifically - and Washington, DC, are the rainbows of the major market NPR news stations.

WBUR is on a roll.

Over the past six months, the station’s market share has increased from 4.5% in February 2023 to 6.1% in July 2023. They’ve moved in ranking from 7th in the market to 2nd, and only 0.1% behind being number one.

In that same period, the station’s weekly Cume has grown from 320,700 to 362,400.

Meanwhile, 500 miles south of Boston in our nation’s capital, WAMU has continued its dominance of DC radio listening. WAMU peaked in January 2021, the month of the Insurrection, forging an astounding 13.4% AQH share in that fateful month. Listening then dropped off for much of 2021. However, this year, the station has regained its lead atop the rankings of DC radio stations, averaging an 11.7% share during the first seven months of the year.

In addition, WAMU’s weekly Cume has held steady, averaging around 537,000 weekly listeners during the first seven months of 2023.

Why do these two stations stand out from the other NPR news stations in the top ten markets?

First, they’re in markets demographically ideal for public radio with highly educated and engaged current and potential listeners. That’s always been true in Boston and DC.

However, they are also in highly competitive radio news markets. In Boston, WBUR competes directly for public radio listeners with WGBH and on the commercial news radio side with WBZ-AM. In DC, WAMU competes against commercial radio news giant WTOP. The two stations typically battle for the top spot monthly in DC.

The two stations’ outstanding performance in light of challenges elsewhere goes beyond the market demographics. More importantly, there is a focus on the basics vital to building and maintaining audiences for radio.

Earlier this week, President of Listener Again Tomorrow, Izzy Smith, published an important column on the Paragon website, which Current republished.

Izzy is currently programming WBUR and has the industry programming chops7 and influence that folks need to be listening to what he has to say. A key point in this post is the need for station leaders to be disciplined in their efforts to serve audiences.

Nothing here is sexy or innovative, but rather a call to be brilliant on the basics of live radio in every daypart on every day.

Little of what follows is about new audiences, but some of it is. If we get sharper about serving the audiences we have and used to have, new audiences will find us more compelling and consistent when they sample what we offer.

Izzy notes eight things areas for stations to be acting on to maintain and grow their radio audience:

Editorial Mix

News Fatigue

Manage Your Messages

Coach Your People

Make Data Visible – Tell Stories About Who’s Listening

Aircheck Pledge Like You Aircheck Morning Edition

Work the Daysheet & Rundowns

Ask for Help

What’s most important about what Izzy has to say in this post is the need for leadership at the station level.

Station CEOs need to empower those in charge of the live broadcast stream to take the actions outlined on Izzy’s list.

CEOs need to allow programmers to have the authority to say no to ideas that take them off the focus of serving the audiences that listen to your broadcast stream. Plus, others in station leadership also need to recognize the vital role of the broadcast stream in sustaining public radio organizations.

That means development needs to support a disciplined approach in its work.

It means that marketing needs to work in tandem with programming and take a listener-first approach to how the station is positioned in the market. This is true off-the-air as well as on the air.

It means that the local newsroom is in alignment with understanding who the audience is and how to produce stories of interest to the people listening to the station.

Most importantly, CEOs must give programmers the time, space, and authority to work and coach with their on-air team to improve the station's sound.

This means that CEOs need to be willing to accept the fact that some difficult conversations may be ahead for them. And they need to provide strong support for their programming leads to build the buy-in on what’s required to serve the audience.

And with that support comes the accountability of the programming lead to deliver on the strategy.

One final note.

Much has been written this week on the news that on-demand audio listening passed linear (broadcast and streaming) consumption for the first time in the most recent quarter.

However, public radio's economics and public service outcomes are still strongly dependent on our broadcast streams.

Last week, Edison Research noted that despite the rise in on-demand listening, listening to AM/FM remains a powerful force in total audio listening, particularly with regard to reach. Bearing in mind that Share of Ear respondents are keeping a one-day audio diary, fully 63% of respondents (among the total sample, Americans age 13 and older) are reached by AM/FM radio content every single day. That is really a huge total – in a typical day, way more than half of everyone age 13+ in the U.S. listens to AM/FM radio.

With the Public Radio Playbook and Izzy’s recommendations, I’m encouraged that public radio can continue to grow its broadcast audience and turn around the recent trends.

Thanks for reading.

City Square Associates prepared the Public Radio Playbook as part of the 2023 Public Radio Meta-analysis Project in partnership with SRG, Greater Public, and PRPD

WNYC (New York), KPCC and KCRW (Los Angeles), WBEZ (Chicago), and KQED (San Francisco).

The population of the Philadelphia market is 4,627,200.

Source: U.S. Census Bureau (2021)

KPBS’s weekly cume from February - July 2023 was 242,867.

It would have a greater impact on AQH and AQH share.

Before starting his consulting firm, Listen Again Tomorrow, LLC, Izzy was the Managing Director of Programming and Audience Development with WBEZ and the Director of Programming at NPR (among other things).

what concerns me is the lack of "driveway moments". Everything is a two way. What distinguishes NPR from other media.? I loved when NPR "took me there"! Finding less and less "there".

I have not been active in public radio for two decades, but still find the details fascinating. Your “three things” covers them well. I will pledge to pay a reasonable fee if that comes to pass.

Izzy’s report is notable to me in that it ignores diversity as a goal. That strikes me as realistic, but does it fly in the academic/public service world?