Three Things on a Public Radio Major Market Meltdown

The NPR News stations in America's largest markets are seeing a dramatic drop in audience

It’s been a while since I’ve looked at audience numbers for public radio, but I happened to see the top-line audience numbers from Nielsen Audio today for some of the top radio markets and was stunned by the drop in market share for many of public radio’s largest stations.

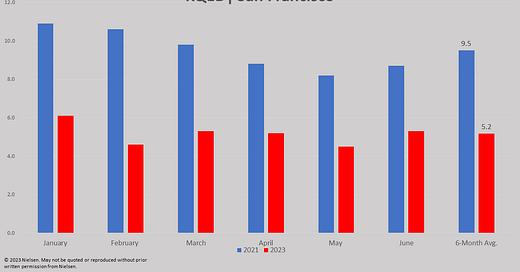

THING ONE: I Left My Radio Listening in San Francisco

On this first day of the June 2023 ratings released today from Nielsen, the stunner for me was the collapse in listening to KQED in San Francisco over the past two years.

San Francisco is the fourth largest market in the country and, along with Washington DC as the top ten markets go, has traditionally been a place where public radio’s audience has excelled.

But something has gone wrong in the Bay Area.

In June 2021, as the country was beginning to slowly recover from COVID-19, KQED had a weekly cume of 734,500 and a market share of 8.7, which happened to place them at the top of the Nielsen Audio ratings in the market.

Two years later, KQED’s weekly cume is down by nearly 200,000 listeners to 559,700. The station’s market share is 5.3, putting them 4th in the market in June 2023. Now in most markets, a 5.3 would have everything doing cartwheels of joy. But this is San Francisco, also known as PUBLIC RADIO HEAVEN.

The first thing you might check is to see if this was just a bad month. But the chart below says otherwise.

In fact, the trend since January of this year is not good (a 6.1 share at the beginning of the year and down to 5.2 at mid-year). Weekly cume has stayed fairly stable through the first six months of the year, but the loss of audience since 2021 is more than medium and small markets reach in a week, or some in a month.

Of course, this kind of audience loss is most likely also having some impact on revenue at the station. However, the station’s most recent fiscal year, which ended on September 30, 2022, saw membership revenue increase from $16.7 million in 2021 to $21 million last year. The station also increased the number of donors in 2022 by around 4% to 87,738.1

Corporate sponsorship also had a sizable increase in 2022 after the COVID downturns of 2020 and 2021.

THING TWO: The Listening Trends in the Windy City Are Blowing in the Wrong Direction

In the months that followed the lockdowns from the pandemic, WBEZ in Chicago was one of the bright and shining stories for public radio audience growth in a market where, historically, public radio never performed all that well in the Nielsen ratings.

In 2021, coinciding with the January 6th Insurrection, WBEZ took off. The station had shares of 6.7 in January 2021 and 6.4 in February, climbing to the top of the ratings in the third-largest market in the country.

But just as KQED has experienced a downturn in 2023, WBEZ has seen a sizable loss in market share this year as well. In addition, the station’s weekly cume has also dropped from 508,300 in June 2021 to 414,200 in today’s release of the June 2023 Nielsen Audio ratings.

The trendlines don’t look great, either.

Sandwiched between 2021 and 2023, in WBEZ’s case, was the acquisition of the Chicago Sun-Times, so perhaps the organization has had its attention turned toward making that critical business decision a success.

WBEZ’s fiscal year ends on June 30th, so the most recent financials date back more than a year. But, the FY 2022 data shows a slight drop in membership revenue and a loss of about 3% in the number of contributors to the station. Corporate sponsorship in 2022 was still reeling from COVID and was also down for the station. However, the big bump in revenue came from foundation support, most likely linked to the Sun-Times deal, which was up nearly three times over 2021.2

It’s also worth noting that foundation revenue and audience growth (or loss) are not usually related.

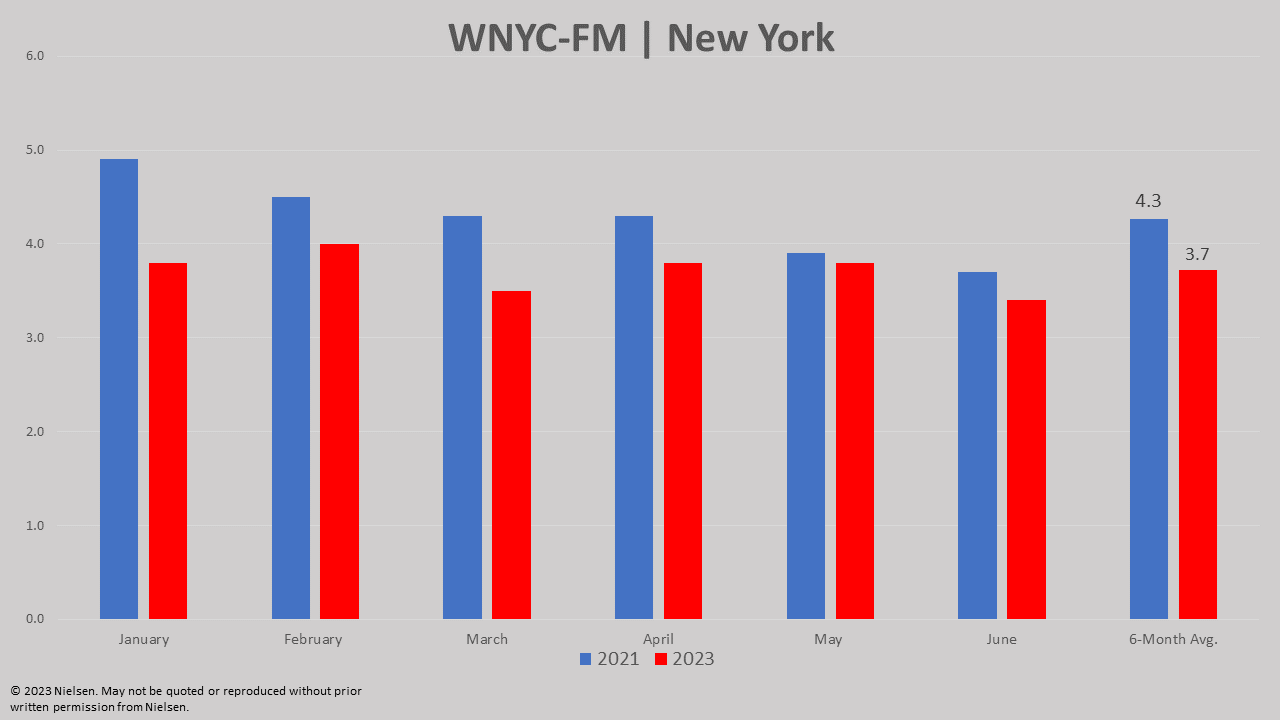

THING THREE: New York and Los Angeles Follow Suit

No one from New York and LA will ever admit that they are following trends from Chicago or San Francisco, but when it comes to these public radio listening trends, WNYC in New York and KPCC (LAist) and KCRW in Los Angeles are mirroring what’s happening in with KQED and WBEZ.

Although the audience drop isn’t quite as severe.

Let’s start in New York.

WNYC’s weekly audience in the just-released June 2023 Nielsen’s was 727,100. This is down marginally against the station’s June 2021 ratings, where the weekly audience was 735,500. However, the station’s market share is dropped by nearly 20% from two years ago. WNYC’s 6-month market share average from January - June 2021 was 4.3. The average for the first six months of this year is 3.7.

This isn’t huge, but it’s definitely trending in the wrong direction.

Meanwhile, the station that was known in 2021 at KPCC and now goes by LAist, has seen its weekly cume drop from 639,100 in June 2021 to 478,500 last month. That’s a pretty severe drop in listeners. The six-month market share average from January - June 2021 was 3.0. The market share is 2.3 for the same period in 2023, a drop of more than 20 percent.

And for KCRW, it’s seen a substantial loss in cume, from 480,200 in June 2021 to 278,900 last month. That’s about a 40 percent loss in listeners. The market share loss isn’t quite that substantial, but it’s still down significantly.

This is just a quick observation from a very small universe of stations, but it’s worrisome.

Sure, the news cycle is different from the early part of 2021, but we’re also seeing a lot more cars on the road and people commuting to work than we saw two years ago.

And the competition from podcasts and on-demand audio is perhaps more challenging today than two years ago. However, that would not account for the loss in market share, which translates into people choosing to listen to another radio option.

What’s changed in the content decisions of stations

in the past two years? Has new competition arrived to challenge public radio's hold on its audience?

Or is public radio not keeping their on the ball in how they are serving listeners?

I’d love to know your thoughts.

Please leave a comment, or let’s get a conversation going with the Substack chat feature.

Thanks for reading.

This data is taken directly from KQED’s Annual Financial Report to CPB.

This data is taken directly from WBEZ’s Annual Financial Report fo CPB.

Spot on, Tim. From our Paragon's research for NPR News stations across the nation, there are many reasons for the decline in listening, including:

1. Some stations are very late to recognize the obvious, which is that serving audience needs is required for growth. It's crazy that in 2023 the industry is just now coining the term "audience development" and addressing it like it's a new concept.

2. Competition for national and international news, in-depth coverage, and local news is increasing, which exposes NPR News and some station's penchant for ignoring major news and breaking news in lieu of a rigid program schedule and sometimes irrelevant, pre-recorded topics.

3. Fund drives have long been audience killers, and now they appear to be sunsetting in relevancy (and results). Stations are late in diversifying their fundraising toolbox in a concerted effort to maintain consistent content instead.

4. Non-listeners and past listeners overwhelmingly feel the presentation is bland, boring, and lacks energy.

5. The national political divide has pushed NPR News and local stations squarely on the liberal side of the dividing line.

6. News cycles ebb and flow. Right now we're in the ebb stage.

The answers to turning the tide are obvious and achievable:

1. Focus on the local audience. Find out (through research) what they want and need, and give it to them.

2. Focus on the daily news cycle, not the daily program schedule. Stations must commit to being the #1 radio news outlet in their markets and that requires more fluidity of coverage.

3. Stop interrupting the content for extended periods by evolving away from fund drives and diversify membership (or "subscriber") concepts.

4. Stop trying to sound like stereotypical public radio and modernize the sound with great voices, quick storytelling, strong local news reporting, and professional imaging production.

5. Stop giving lip service to balanced coverage and diverse POVs and deliver on it without prejudice.

6. Be prepared for the news cycle to flow back up in the next 18 months for the next national elections. Seize the opportunity.

I hope this generates more discussion. Thank you.

For these five stations, I'd like to know where the losses occur in their schedules, if there is a trend among them. Morning and/or afternoon drive? National vs local content? Weekend mornings?