Three Things: The Arrival of Public Radio's FY 2024 Financials and The Challenge Ahead

With challenges on multiple fronts, public radio faces a daunting 2025.

THING ONE: The Mess in Sacramento

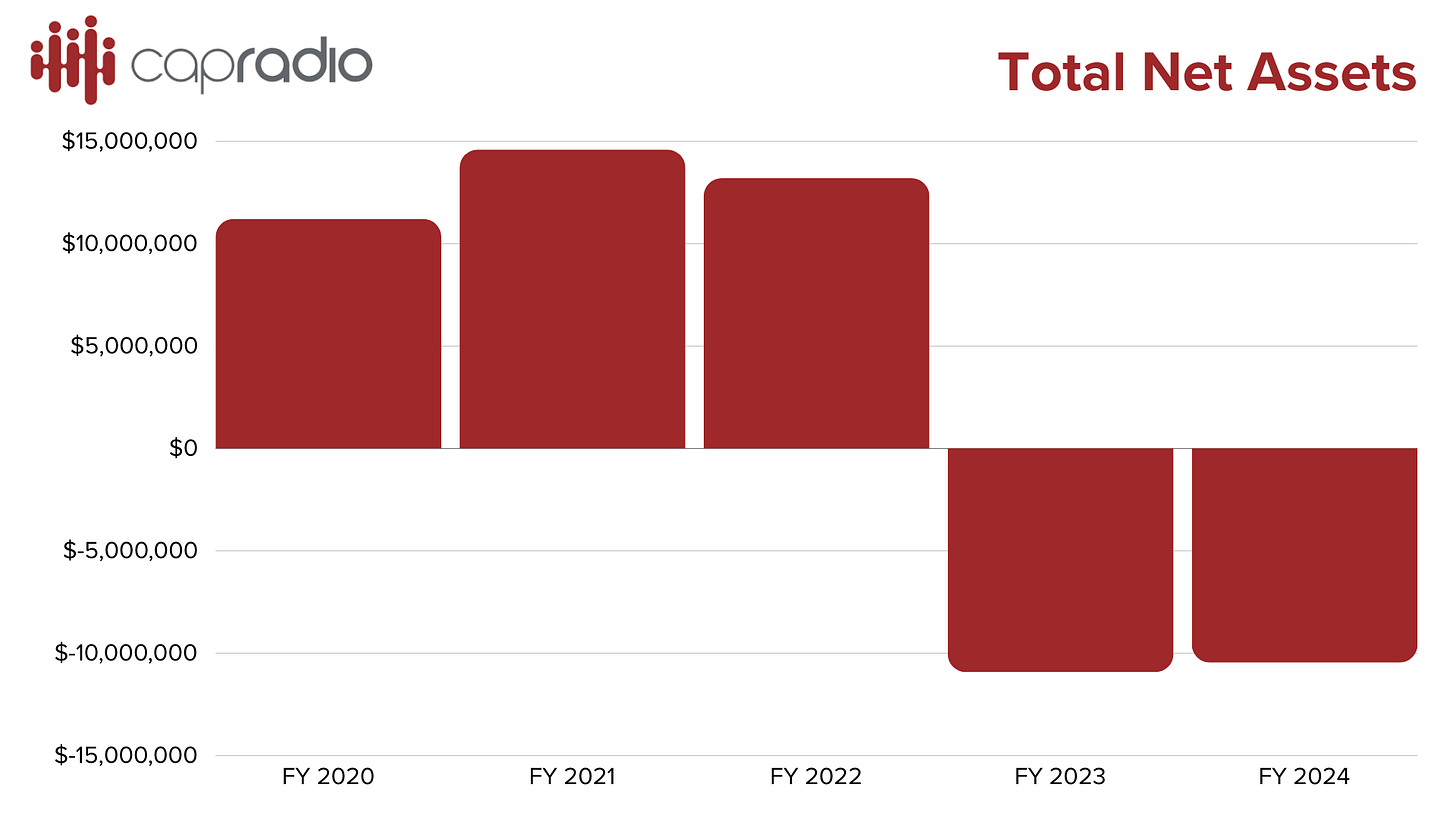

Last week, Capital Public Radio, based in Sacramento, CA, released its most recent audited financials for the fiscal year ending June 30, 2024. The report showed a significant deficit of $10 million from an operating budget of $13.5 million.

The audited financial statements, based on reporting from the station’s newsroom, revealed that the station owed an estimated $9.7 million to several organizations as of the end of the most recent fiscal year. According to Capital Public Radio’s Chief Marketing and Revenue Officer Chris Bruno, $2 million is owed to vendors, while $7.7 million is owed to its licensee, Sacramento State.

According to reporters Chris Nichols and Claire Morgan, the station has taken steps to rectify these issues, including reducing payroll, cutting back on construction projects, and renegotiating debt. Despite these challenges, CapRadio remains optimistic about its future, citing increased membership support and a renewed focus on community engagement. The station is working closely with Sacramento State to stabilize its finances and ensure its long-term sustainability.

The audit also raised concerns about CapRadio's ability to generate sufficient revenue to cover its expenses. Auditors cited ongoing investigations and a significant net asset deficiency as reasons for these concerns. However, they also noted that the station is on track to stabilize its financials and that its solvency is not solely dependent on the outcome of these investigations.

The Sacramento Bee reported that the station reported $7 million in total assets as of June 2024. Total assets jumped from $20 million in 2021 to $40 million in 2022—an increase never seen in the radio’s finances, which stretch back over a decade. In 2023, assets decreased to $5.6 million.

Earlier this year, a months-long forensic examination of financial mismanagement took place at Capital Public Radio.

In an August 2024 interview with ABC10 in Sacramento, Sacramento State University President Dr. Luke Wood said, "Capital Public Radio had lax controls, lack of financial oversight, money that was being reported in ways that didn't make sense. We found out that they had reported having a $3 million reserve and, at that point in time, had only around $80,000.”

"People were hurt. The campus was impacted. The community lost trust. Those are never the kind of things that you want to walk into as a new president. One person had the ability to sign things without there being any counterbalance within the organization. That person used that position and that unique setup to be able to personally benefit from Capital Public Radio."

The chart above shows the station’s Net Assets from its audited financial statements over the past five years. However, the data from 2020 through 2022 might be suspect, given the alleged financial mismanagement during this period.

The station reported membership revenue of $9 million (down 5% from 2023) and underwriting revenue of $2.48 (down 21% from the previous year) in the fiscal year ending June 30, 2024.

THING TWO: $15 Million in Losses at SCPR Over the Past Two Years

The most recent fiscal year for Southern California Public Radio (SCPR | LAist | KPCC) week ended on June 30, 2024; twelve days later, the organization implemented a 17% staff reduction, which included laying off seven employees with 21 others accepting voluntary buyouts.

The audited financial statements for SCPR were released earlier this fall, showing a drop in net assets of $8.7 million at the end of the 2024 fiscal year. On July 1, 2022, SCPR had net assets of $43.6 million. On June 30, 2024, its net assets had fallen to $27.9 million.

Total 2024 revenue was $35.1 million, down $1.5 million from 2023. By comparison, SCPR had revenue of just under $43 million in COVID-impacted years of 2022 and $38.2 million in its FY 2021.

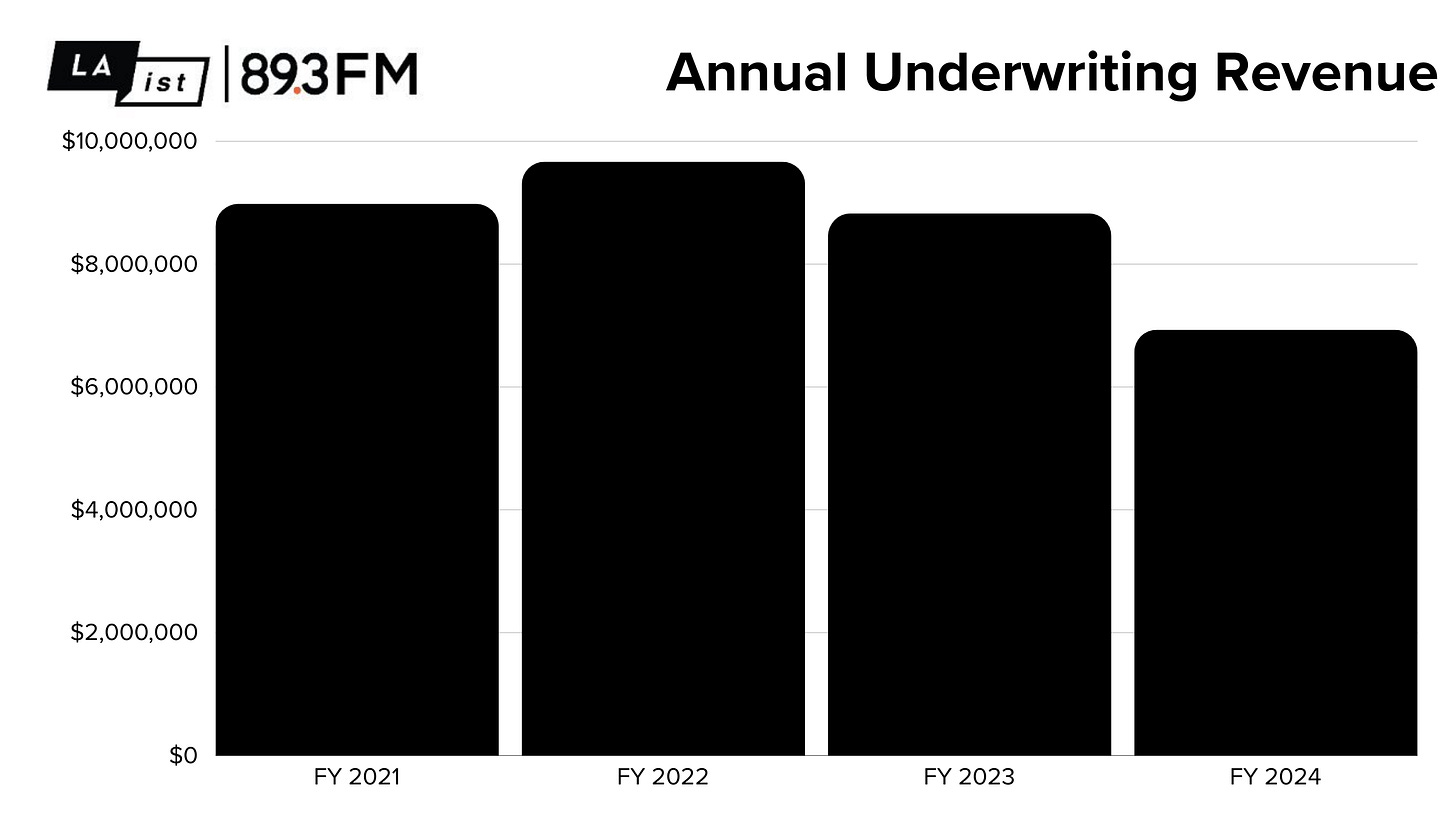

The station reported a slight increase in membership and individual giving revenue in 2024 over the previous year ($20.4 million to $19.8). However, a nearly two million dollar drop in underwriting accounted for much of the revenue loss in 2024.

THING THREE: What’s Next for Public Radio

As someone who has been away from public radio for two and a half years and from a station for more than four, I admit I’m only privy to publicly available information. Still, given what’s out there, the immediate and most likely long-term issues for public radio are very problematic.

Let’s start with CPB.

It’s easy for many to say that someone like Marjorie Taylor Green may not be a serious person when it comes to legislative policy, but at this moment, her words have some meaning. So when she goes on FoxNews and specifically calls for the defunding of CPB, that’s worrisome.

One could say that public media has made it past political turmoil over the past 55-plus years of CPB funding, but I worry that public media, as is all of journalism, is facing a very different battle this time.

The period that this moment resembles most closely is from 1994 - 95, following the Republican takeover of the House and Senate led by Newt Gingrich, who, as the incoming Speaker of the House, announced his intention to “zero-out” public broadcasting.

What was different then was that Bill Clinton occupied the White House and that the pre-World Wide Web media landscape was entirely different thirty years ago than it is today. One could also comfortably say that public radio and television had many more friends on the Republican side of the aisle in 1995 than today. This is particularly true regarding NPR in the aftermath of the Uri Berliner controversy earlier this year.

Take the case of the two stations referenced earlier.

Over the years, Capital Public Radio’s CPB funding has provided millions of dollars - with no fundraising costs - to support the station’s local and national programming and other operational expenses. It’s important to remember that if fundraising dollars are used to replace CPB funding, you need to raise an additional 20-30% more to cover the fundraising costs necessary to raise those funds.

At SCPR, their financial reports show CPB funding of $1.67 million, which some local funders might step in to replace that amount in the short term. However, is that sustainable over the long term?

It’s also worth noting that CPB funds the fees for music rights and numerous journalism projects that would need replacement funding if it were “zeroed out.”

The loss of CPB funding will also significantly impact smaller stations. With 75% of federal dollars going to public television, joint licensees would also face more significant challenges than some radio-only operations.

Former VPR CEO Scott Finn wrote an excellent piece about potential CPB defunding for Current earlier this year.

However, CPB is hardly the only challenge faced by public radio.

Despite recent spikes in market shares at many public radio stations over the past few months, most stations' weekly cume audiences have not returned to pre-pandemic levels. Given the changing nature of audio consumption, they probably never will.

Public radio's audience loss has been well documented. Numerous stories have reported on its efforts to “recapture listeners with shorter stories, not only to increase its radio listener base—older Millennials, Gen X, and Boomers (aged 40-64)—but also to ensure the people it already reaches don’t leave.”1

“More than two-thirds of our broadcast audience is over 45, but for more than five years, the only age demographic that has grown in that audience are those over 65,” Chapin wrote. “All this supports our broader goal to understand better and serve the curious – an audience that reflects the full diversity of America and where we see enormous potential for growth across platforms.”

If you haven’t read Eric Nuzem’s excellent post regarding this strategy, you should.

His most crucial take is this:

Public radio has no shortage of listening data and audience research that pretty much universally say one thing, over and over again, in data set and research study after data set and research study:

Public radio is less compelling now than it used to be.

While we await more financial information from public radio stations' 2024 fiscal years, the news is unlikely to be positive.

In the meantime, fourth-quarter fundraising is likely to increase as loyal listeners respond to the Presidential election results. However, can this be sustained beyond one or two pledge drives?

Finally, for public radio news stations, there is the threat of the unknown how an aggressive Federal Communications Commission and Justice Department will respond to journalism organizations that report negative news about the incoming President and his administration.

There has never been a more critical time for public radio to come together with a cohesive strategy for serving audiences, raising money, and demonstrating its value to a divided nation.

There is no handbook on achieving this task at this moment. My aspiration for the industry is that it can unify, concentrate on essential matters, and set aside many of the internal conflicts that have adversely affected it in recent years.

I wish you well.

Bloomberg, National Public Radio Confronts Election Season With a ‘Joy Czar’ from August 29, 2024.