Three Things Special: Deficits Mounting for Public Radio from 2023

A quick analysis shows losses of $28 Million for public radio's largest stations.

The headlines below over the past several months speak for themselves.

WBEZ. American Public Media. WBUR. Colorado Public Radio. WNYC. Capital Public Radio. WAMU. SCPR (KPCC). KCRW. WLRN.

Many others are facing similar challenges as budget deficits at large and smaller public radio stations bring financial challenges not seen since the Great Recession fifteen years ago.

An analysis of audited financial statements from the 2023 fiscal year shows worrisome results for public radio, which also faces declines in audience in the post-pandemic media environment.

These station budget problems follow NPR's financial challenges from a year ago when the network announced it would lay off roughly 10% of its current workforce.

THING ONE: The Top Markets

First, I have chosen to review only the financial statements from radio-only operations for most of this analysis. In joint licensee situations, there is so much co-mingling of dollars, both on the revenue and expense side, that it is very difficult to realistically sort through the data to draw any major conclusions.

I will touch on a few joint licensees in Thing Three to highlight where some organizations stand amid these challenges.

To start, let’s look at stations in some of the country's most important markets: WNYC, KPCC, WAMU, and WBUR. I would include KCRW and WBEZ in this group, but unfortunately, they have not published their 2023 financial statements from their most recent fiscal year, which ended June 30, 2023.

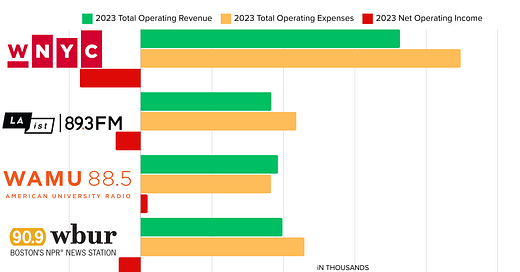

The chart below shows the 2023 revenue, 2023 expenses, and net income.

Last year, the combined operating deficit for these four stations was around $28 million.

Now, $17 million of this was WNYC alone, but add $7M from LAist and over $6M from WBUR, and the picture is not pretty. The only station that finished 2023 with a surplus was WAMU, which, despite that, was still forced to make some difficult budget decisions earlier this year. In total, the four stations deficits were around 15% of their total revenue in 2023.

The 2023 deficits followed deficits in 2022 of $3.37 million for WNYC and $3.9 million for WBUR. KPCC ($5.3M) and WAMU ($6.5M) finished 2022 with solid surpluses.

While it may or may not be related, the weekly cume audiences for most of these stations have also fallen over the past few years.

WNYC, which had its best-ever market share of 4.7% in February 2024, has lost more than 100,000 weekly listeners compared to 2021. KPCC lost close to 200,000 listeners in that period. Meanwhile, WAMU and WBUR have maintained most of their weekly audience over the last few years.

THING TWO: Is it only a Major Market Problem? Um, NO.

Let's look at the next tier of stations: KUOW in Seattle (market #11), WUSF in Tampa (market #17), Colorado Public Radio (market #18), and WFAE in Charlotte (market #21). These results are pretty dismal as well.

KUOW ran a $2.4 million deficit in 2023, WUSF was down close to a million dollars ($998,802), Colorado Public Radio was in the red by $2.34M, and WFAE was down close to $1.5M.

The combined deficits of these four stations are more than $7 million, or around 10.5% of total revenue.

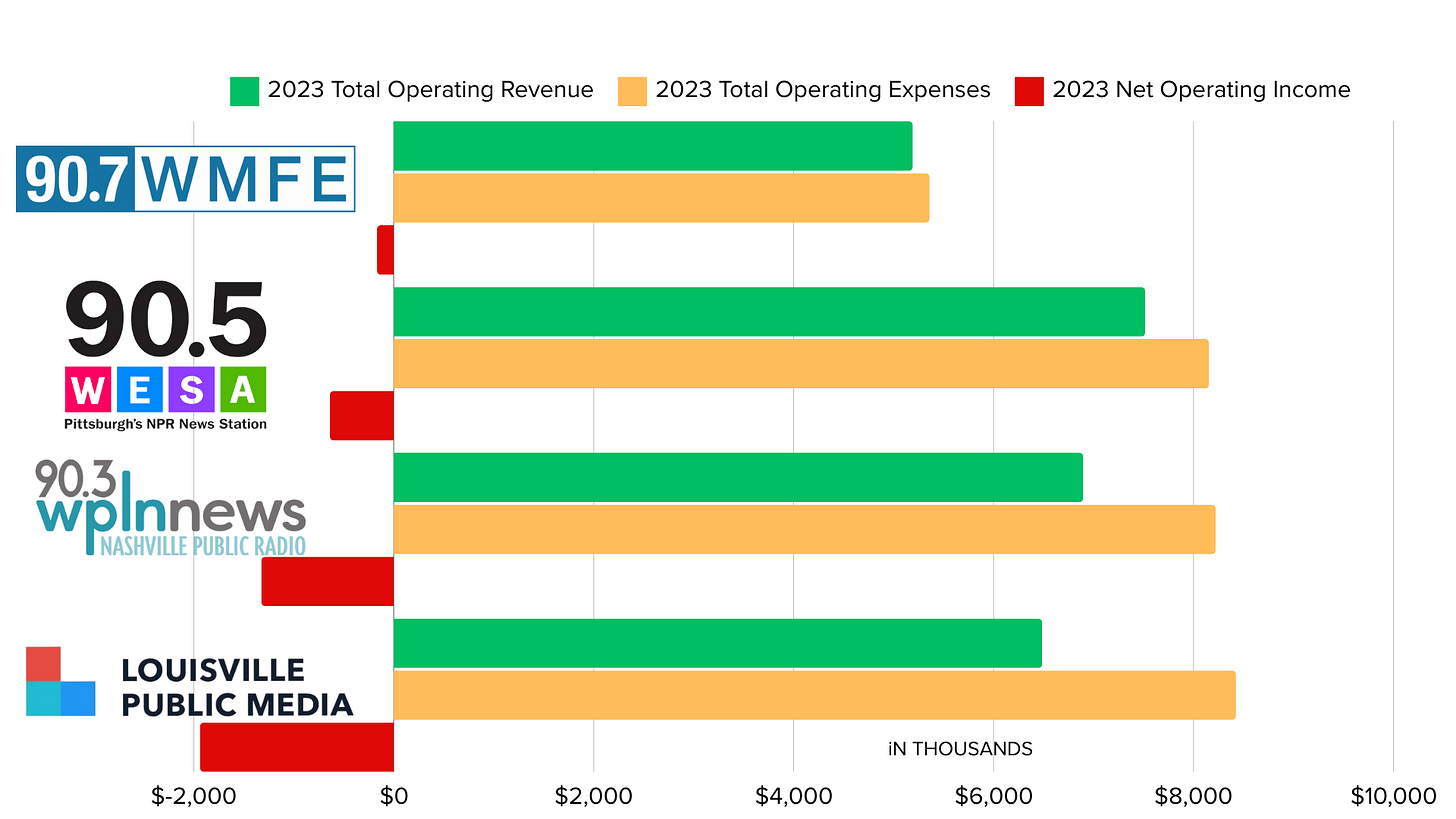

Here are four more stations that would qualify in the middle market category.

WMFE in Orlando, WESA/WYEP in Pittsburgh, WPLN in Nashville, and Louisville Public Media. These four stations had a combined deficit of over $4 million in 2023, about 15% of their combined revenue of $26 million.

These examples do not suggest that every public radio station is running a deficit.

However, my analysis of 2023 financial reports from dozens of stations signals some significant industry challenges.1

THING THREE: A Few Joint Licensees and Looking Ahead

Interpreting audited financial statements from public media organizations can be somewhat challenging because of how many university stations report their financials. Add to that the complexity of how joint radio-TV licensees report their data when there is usually such an overlap between the broadcast operations. For example, who gets credit for a major gift when someone who loves both radio and television donates to a joint licensee? In most cases, television does because the incentive rate in CPB matching funds has historically favored TV revenue over radio.

Nonetheless, I pulled out a couple of joint licensees who run very successful radio and TV operations to see how they’re doing. The results are mixed.

KERA in Dallas-Fort Worth, which acquired the Denton (TX) Record-Chronicle last year, lost over $3 million in its 2023 fiscal year. Meanwhile, KPBS in San Diego, which receives over $2.1 million in cash support from its licensee, San Diego State University, also ran a deficit. In addition to the cash support that the station receives, it also reported indirect financial support from SDSU of nearly $6 million.

Finally, we look at WOSU in Columbus. The station also receives a large subsidy from The Ohio State University, which was $1.6 million in 2023. Without that university's support, the station would have had a nearly $2 million deficit out of a $14 million budget.

So all of this begs the question of what’s been the cause of these financial difficulties?

I’ll focus this response on public radio. For the sake of transparency, I’ve been away from the daily business of public radio for a couple of years, so these are my observations with some basis on publicly available data.

The Loss in Audience

As I wrote last year in this newsletter, public radio is losing listeners. A lot of listeners. You can point to changes in media habits coming out of the pandemic. You could also point to increased competition from outlets like The New York Times audio products and other on-demand producers.

However, I believe the most significant reason for this loss of listening is that public radio news programming has lost its focus on who its audience is and who it should be.

Public radio’s audience growth over previous decades happened because the network, primarily NPR, and stations took an Audience First approach in producing its programming. As John Sutton recently wrote in Current, “Programming causes Audience.” If you’re not serving the audience, they will go elsewhere, resulting in fewer listeners supporting a station and making it more challenging to sell on-air sponsorships.

The staleness of public radio combined with feeble attempts to attract new audiences to a service that probably isn’t meant for them does not bode well for the industry. If you want to reach new audiences on public radio, create a format that will do just that. Use The Drop in Denver as an example.

I can’t resist mentioning one other small example where resistance to change is killing public radio. Thirty years ago, Weekend All Things Considered, which airs at 5 p.m. Eastern time on Saturday and Sunday afternoons, had a loyal and reasonably decent audience as a lead-in to A Prairie Home Companion on Saturdays. Why is NPR still investing in producing a live newsmagazine at that time in 2024 when radio listening by late afternoons shrinks to almost nothing? Wouldn’t it better serve listeners to move it up to a 2 p.m. start time to actually serve listeners?

On-Air Pledge Drives Are Dying

When I worked in public radio, I never realized how torturous pledge drives are for listeners. For decades, pledge drives have been the pipeline for new donors, and that pipeline is drying up. I don’t know if pledge drives have actually gotten worse. I just think the approach has gotten more and more stale and painful over the years — and when you’re losing listeners, the pool to attract new donors has shrunk.

Inflation

One cannot deny that it cost more to do much of anything in 2024 than it was in 2019. Stations spend more to run their transmitters, buy office supplies, and pay their staff. Plus, it goes without saying that programming from the networks is also not getting any cheaper and, in most cases, not providing the return on the investment it did a decade ago.

The Podcasting Misadventure

Many of the stations that have announced cutbacks have chosen to reduce their investments in podcasting. This week’s news of cuts at WBEZ in Chicago focused on scaling back several of its podcasts. Such was the case at American Public Media, WNYC, and Colorado Public Radio. The business model for many station-produced podcasts has just not added up, and stations are stepping back to assess a way forward. No one is suggesting that podcasting is going away. However, the industry must find economic and public service models.

The Federation is Dying

As I look in from the outside, the most serious challenge facing the industry is that the federated system of public radio is outdated and unsustainable for the future. While the branding of “The NPR Network” is a nice way to position NPR to raise money and throw a little of it back to stations, the system needs to think bigger about how it operates going forward. The governance of public radio makes this a considerable challenge, but that shouldn’t deter the industry’s brightest people from working through this barrier.

Public radio needs to look no further than Axios Local, 6AM City, or CityCast for editorial and economic models2 that maintain a local presence but significantly reduce the overhead operational costs. CDP is working to do this for station membership activities, bringing best practices and the latest technology to stations of various sizes.

A friend of mine from a university shared with me some core steps for businesses to solve problems that perhaps the industry should be thinking about:

Identify and define the problem — AND BE HONEST WITH YOURSELF

Consider possible solutions — BUT DON’T GO IT ALONE

Evaluate options — BUT DON’T GO IT ALONE

Choose the best solution — AND BRING OTHERS ALONG

Implement the solution — THIS CAN’T BE DONE ALONE

Evaluate the outcome — AND BE HONEST WITH YOURSELF

I hope the headlines for public radio will move from the bad news of layoffs and cutbacks to what it’s doing to innovate, serve more Americans, and play a key role in keeping local news alive in communities large and small nationwide.

What's your take on the state of public radio? Please share your thoughts and ideas in the comments and start a conversation about the future. Thanks for reading.

Several medium-sized market stations have yet to release their FY 2023 financials. This includes stations in Kansas City, St. Louis, Baltimore, and Capital Public Radio in Sacramento, which is under investigation for faulty financial reports.

Please do not look to Gannett or any of the major newspaper chains as a model!

Tim, sharp, incisive....and courageous, as always. I know some will gravitate to the "externals" - COVID, competition, and I could add in the news cycle. But it feels more like the inability to adapt and/or resistance to accepting these changes and developing new strategies. Paul and I will have more to say about all this in the coming weeks as we begin to prep for PRTS 2024, preparing questions to help stations determine "what's wrong?" and "how can we fix it?" The audience must be given a voice and a seat at the table. Thank you for brilliantly teeing this up.

FWIW, just one listener's experience, but there are just so many options, and NPR programming is predictable, stale, and from a journalism perspective, uni-dimensional. My impression is that appeals to some, sort of a place of comfort. But that's not what I'm looking for. I also wonder how work from home has impacted listener numbers. There are far fewer rush hour commuters these days.