Three Things for September 23, 2021

This week: Mergers, acquisitions, and what could be next. Plus, where news audiences are going and what drives audiences to pay for news.

EDITOR’S NOTE: In the original version of this post that went out by email, I somehow neglected to not include Colorado Public Radio’s achievements in Thing One. CPR took over the operation of KRCC in Colorado Springs in early 2020 and CPR also runs three distinct formats in Denver. My apologies to the good folks at CPR for the oversight.

THING ONE: Mergers and Acquisitions and PSOAs… OH MY!

Last week’s news that the board of trustees from Kent State University agreed to a public service operating agreement (PSOA) with Ideastream in Cleveland to take over the operation of WKSU marked the latest in a series of deals that we’ve seen in public radio since the onset of the pandemic 18 months ago.

We’ve seen the historic merger between Vermont Public Radio and Vermont PBS that was finalized this summer. In the coming weeks, WFYI1 in Indianapolis is expected to officially take over the operation of WBAA-AM/FM in West Lafayette, IN, after an announcement this summer.

But there’s more:

WYPR in Baltimore announced in late May that it was purchasing Triple-A format WTMD (88.7 FM) from Towson University for $3 million.

In April, CapRadio, based in Sacramento, took over Humboldt State University’s KHSU in Arcata and four other stations licensed to the university. This came on the heels of a similar deal with North State Public Radio (NSPR) in Chico, CA, in October 2020.

And in January 2020 (just before the pandemic), Colorado Public Radio and Colorado College entered into a PSOA to operate KRCC (91.5 FM) in Colorado Springs, CO.

These are all very good for public radio. We are in a moment that public radio needs to explore new service models, and it’s critical that these licensees stay in the public radio system.

In nearly all of these deals, a public university is involved (Vermont being the exception), and that Public Media Company had a hand in making the deals happen.

So what else might be happening in the deal-making space for public radio?

Let’s start in Dallas.

Over the summer, the city of Dallas’ Office of Arts and Culture released a statement that it had issued an RFP seeking a nonprofit entity to take over the operation of its financially struggling classical music station WRR (101.1 FM). In July, the Dallas Morning News reported that there were two front-runners to take over the operation: North Texas Public Broadcasting (operator of KERA-FM/TV and KXT) and the Dallas Symphony Association.

This would be a big deal for North Texas Public Broadcasting, giving the organization frequencies for news, Triple-A, and classical music. The Twin Cities and Denver are the only Top 25 markets with those three formats under one ownership with Minnesota Public Radio and Colorado Public Radio. In the Nielsen Audio PPM Monthly Ratings, the three MPR stations in Minneapolis/St. Paul combined for a 12.8 share and CPR’s three services had a combined 7.5 share in August.

When you look at the rest of the public radio ecosystem, there are numerous opportunities for new working models. In the top 50 markets, depending on how you count them, there are six or seven markets2 where two stations are airing the NPR newsmagazines simultaneously. This might seem like a good starting place, although I would rule out most of these markets for various reasons. However, only a couple are worth mentioning.

Atlanta. This is the second-largest market3 in the country without a full-time analog classical music station. Instead, WABE and Georgia Public Broadcasting (WRAS-FM) both broadcast Morning Edition and ATC, with neither station reaching the potential audience for a growing market like Atlanta. WABE was 13th with a 2.8 share in the August 2021 Nielsen Audio rankings, and WRAS was 26th with a 0.6 share. Sadly, this is where governance4 will stymie any hope for change as it’s unlikely that these two entities would ever be able to come together to forge a public service model that is audience first.

Detroit. In certain parts of the Detroit metro, you can hear three stations carrying Morning Edition and ATC. Each station (MichiganRadio, WDET, and WEMU) has unique identities to serve audiences in the market. MichiganRadio focuses on a statewide audience with its news and information service. WDET seeks to be the public radio voice for the city of Detroit, and WEMU brings jazz and other music with a focus on serving listeners in Washtenaw County in the suburbs. Unfortunately, the three stations are licensed to different state universities making potential collaborations a challenge, to say the least. Similar situations also occur in smaller markets, like Lexington, KY, where two state university licensees mean very little can be accomplished to serve listeners with unique and specific formats.

Columbus. In August, WOSU-FM, owned by The Ohio State University, was the number one ranked station in the market with an 8.1 share. WCBE, owned by the Columbus Public Schools, isn’t a Nielsen subscriber. Both stations simultaneously carry Morning Edition and ATC. There have numerous attempts to forge a partnership over the years, but, again, personalities and governance issues have always gotten in the way of any movement. What’s sad about this situation is that the struggling Columbus Public Schools has poured millions over the years into keeping WCBE afloat. In FY 2020 and FY 2019, they provided $768,500 and $872,250 to sustain the station compared to total membership and underwriting revenue of $532,164 and $790,152. An audience-first approach would allow WOSU to operate the station allowing it to add a Triple-A service to the market alongside its news service and classical music format currently on WOSA-FM.

Probably the bigger opportunities are outside of large and medium markets with state or regional collaborations. This is where financial challenges facing higher-ed institutions can drive the move to new models similar to what happened two years ago when WGLT in Bloomington/Normal, IL, took over the operation of WCBU in Peoria. WGLT is licensed to Illinois State University and WCBU to Bradley University.

That certainly seems to be some of the reasoning behind the WKSU-Ideasteam deal since Kent State had been allocating $455,000 annually to support WKSU.

What I like about the coming together in Cleveland is the creativity in how the programming will be flipped to bring the news and classical music services to the largest potential audiences as possible under the new operating agreement.

I look forward to watching how Ideasteam markets these changes to listeners (and potential listeners) so that audiences can find the programming they want on the multiple stations within the new news and classical music services.

The WKSU-Ideastream deal came about, in part, thanks to a $100,000 grant from CPB’s Collaborative Operations and Services Grant Program. This program is still around, and I hope to see more stations seeking funds to explore alliances with other stations and organizations in public media.

THING TWO: The Future for News and Media Consumption

Rarely does a week go by where some research comes out looking at consumption trends for media, and this week there have been several studies out that paint a fascinating picture for the future.

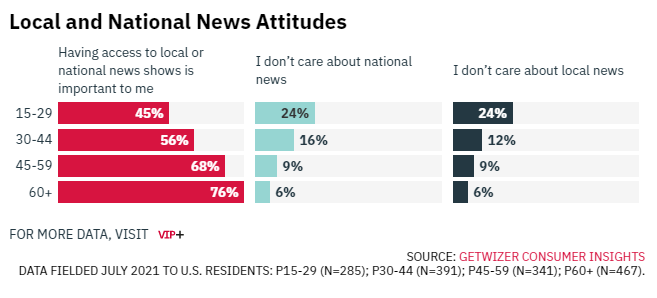

The first is from getWizer Consumer Insights, which focused on TV news consumption published last week by Variety. The study, done in July, looks at the importance of news to different age groups across America.

The research raises alarm bells that digital natives, those between 15 and 29, have the greatest apathy of any generation for national or local news — or even caring about access to it. I, personally, would push back a little to this because we’ve found over the years that as people age, they become more engaged about news, both locally and nationally.

However, we should be concerned about where they will go for news when they “age into it.” That’s where this study provides something to think about it.

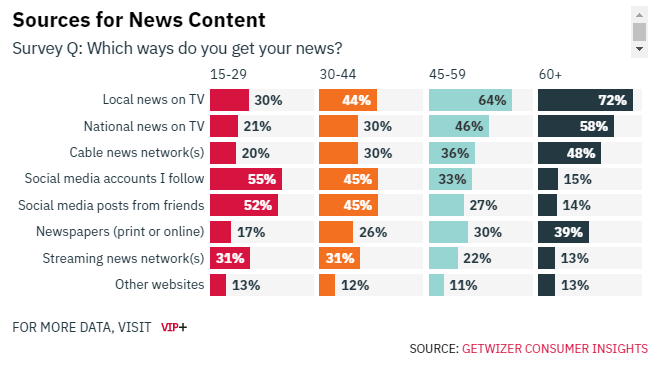

I find the chart above a little frustrating since the researchers do not include radio as an option in the survey question. Nonetheless, the reliance of young people on social media and streaming compared to older consumers is fascinating.

A Pew Research study released this week also showed the heavy reliance of younger people for consuming news on social media in comparison to those 50 and older.

The chart above shows the shift away from Facebook by younger people (18 to 29), who are far more likely to regularly get news on Snapchat and TikTok than other age groups.

However, Pew’s study still shows that 31% of U.S. adults say they get their news regularly on Facebook. In contrast, about one-in-five Americans say they regularly get news on YouTube (the largest age group for YouTube news consumers are between 30-49 years old). In addition, about 13% of Americans regularly get their news on Twitter.

Another study from getWizer and Joy Ventures looked at the social media habits of Gen Z from March 2021 and found that TikTok was the leading platform for those aged 15-17. Instagram is favored most by those between 18-20, while Facebook leads the way for the 21-24 age group.

In addition, an astounding 20% of respondents say they spend five hours or more on TikTok while 18% spend a similar amount of time on YouTube.

Gen Z’s interaction with social media platforms also satisfies various needs. Instagram, for example, is the number one destination for Gen Zers when it comes to connecting and interacting with one another. On the other hand, YouTube is the go-to platform when they are seeking information or want to pass the time — if they are bored, sad, or alone.

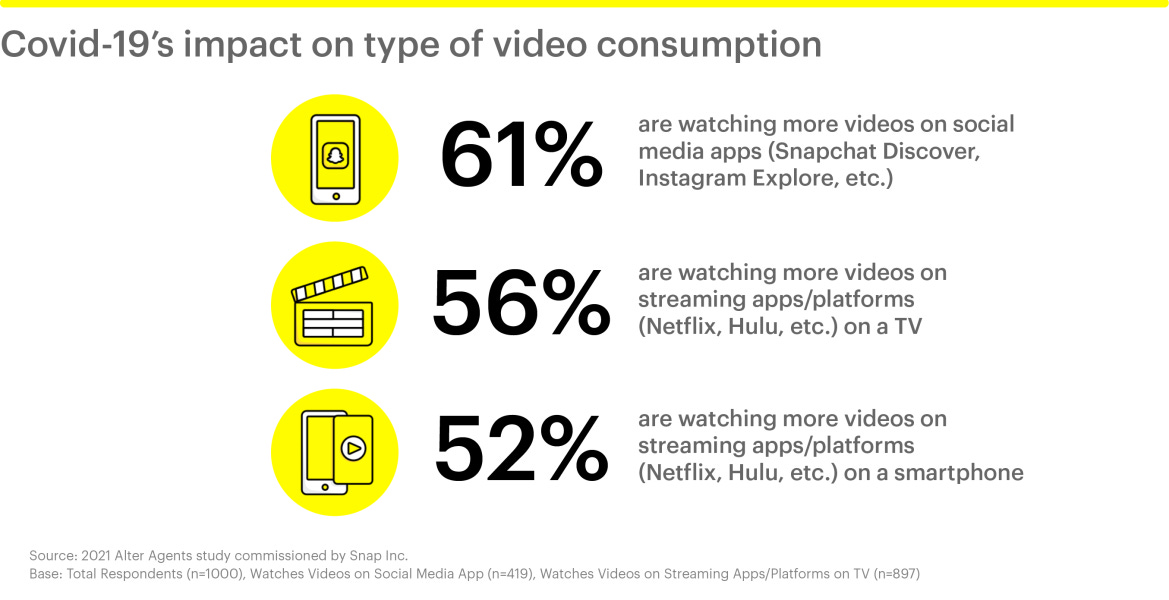

The implication of all this research reinforces that to reach younger audiences, public radio news organizations must go beyond our traditional channels and, perhaps, expertise, with a specific focus on developing video products to go with audio and text.

THING THREE: The Number One Driver To Get People to Pay for News Content is …

We’ve been spoiled in public radio with the megaphone of on-air pledge as a vehicle to attract new donors to our organizations. Whether it’s still entirely relevant today5, we learned more than two decades ago about the five key steps on the “Stairway to Given”6 that helped public radio create the strategies and tactics to move listeners to become donors.

For news publishers who are quickly moving from revenue models dependent on advertising to subscription-based models, finding the secret to convert readers to subscribers has been its focus in creating sustainable revenue streams in the digital publishing world.

As public media looks to grow revenue from our digital publishing platforms, we can learn what others are doing to build their subscriber base. In December 2020, Digiday featured a podcast interview with Amy Adams Harding about what she had learned as the Director of Analytics and Revenue Optimization, News and Publishing at Google.

The first piece of advice from Adams Harding is that digital news organizations should be “making sure that you’re employing e-commerce-like tactics.”

This begins with email newsletters. According to Adams Harding, Google’s data tells us that the people who subscribe to a free email newsletter are the ones most likely to pay for a membership or a subscription.

“When you think about it, newsletters are really a zero-dollar subscription”, she said. “They’ve already subscribed to something. I can’t think of a publication that I’ve worked with where a newsletter hasn’t been their number one driver of subscriptions. And so we spend a lot of time working with our partners, big and small, on their newsletter strategy, because it is an incredibly important driver,” she told DigiDay.

Loyalty (i.e., personal importance) is the top indicator of a propensity to subscribe (or donate).

Following along the newsletter theme, the Public Radio TechSurvey (PRTS) 2021 from Jacobs Media and PRPD asked public radio listeners about newsletter consumption for the first time. The results were remarkably positive about the reach of this tool to communicate with audiences.

Adams Harding also notes that leading with your mission and values is more powerful than thank you gifts.

Another e-commerce tactic is designed to take the friction out of transactions and give users a few price points to determine how much to give. Greater Public’s Melanie Coulson has an excellent piece in Current stressing the urgency for public media to prioritize digital revenues that align closely with Adams Harding’s points in the podcast.

Another suggested tactic from the Google data is to include “you can cancel at any time” in your subscription or membership offer. Again, this should not surprise us as it is regularly a part of the pitch we make with sustaining memberships.

The final recommendation seems somewhat counter-intuitive but is worth thinking about at many organizations. Adams Harding suggests that news publishers, at least in the short-term, rethink their hiring priorities. She says a big obstacle to news publishers acting more like e-commerce companies is their internal talent pool. Publishers’ technology teams are often focused on the production and distribution aspects of journalism rather than the business side.

Their technology teams need people who have worked in e-commerce in order to push these monetization skills to the fore. E-commerce techniques can make a news publisher feel not just authoritative and trustworthy but also friendly, convenient, and easy to use. They usually don’t teach you that in journalism school.

There are numerous tools and options that stations can consider to help them move forward with speed to make an impact quickly. For example, the Google News Initiative’s Data Tools for News Organizations provides a suite of free tools to help optimize your data collection, your reader engagement funnel, and your content in real-time. Another option here is to consider handing off some of this work to organizations like CDP that can manage some of the technology needs and bring scale to the work of membership revenue generation at stations.

In closing out her piece her Current, Melanie Coulson noted “We still don’t know what the “new normal” will look like for public media workplaces, but elements of what that looks like for digital fundraising are clear. On-air campaigns continue, but for many stations on-air drives aren’t bringing in enough revenue. Effective digital engagement — coupled with swift, easy transactions and truly engaging incentives — will determine our success.”

Here’s to that!

Metropolitan Indianapolis Public Media is the licensee of WFYI.

Los Angeles, Atlanta, Boston, Seattle, Detroit, Denver, and Columbus. I didn’t include Cleveland on this list due to last week’s announcement.

Houston is the largest.

Public Broadcasting Atlanta operates WABE under a PSOA with the Atlanta Public Schools. Georgia Public Broadcasting operates WRAS under a PSOA with Georgia State University.

Wisconsin Public Radio’s Michael Arnold wrote about the need for updated research in this piece in Current back in 2018.

You have to listen. You have to rely on the programming. You have to find said programming personally important. You have to believe public radio needs your support. You need to be able to afford to give.

Hi Tim,

Thank you for another very insightful Three Things article.

I find it very difficult to be enthused about the mergers and acquisitions. For over four years I’ve worked at a small station in Pittsburg, KS not unlike the stations that were swallowed up by larger ones you write about. I’ve often wondered if my little station could one day become a repeater for better-financed neighboring stations KCUR, Kansas Public, or KMUW just to name stations in Kansas.

Also, why is station consolidation in commercial media viewed one way and portrayed another way in public media?

They both serve similar purposes. To save money for one party and try to make more money for the party that takes over. KSU didn’t want to support their station anymore, so Cap Radio stepped in. When you’re hired at North State Public you’re actually a Cap Radio employee. Who does that benefit? The GM and station management that pulls deals together to consolidate and work to create huge, sometimes statewide networks.

It doesn't likely doesn’t benefit, my friends and colleagues who have been laid off as a result of some of the mergers and acquisitions you’ve written about. Surely, you know some of these individuals as well.