Three Things for October 14, 2021

This week: Be the first to try New York Times Audio. Plus we look at Borrell's Local Advertising Forecast for 2021, and the crowded digital home.

THING ONE: The New Listening Experience from The New York Times

On Tuesday morning, The New York Times revealed that it would soon be rolling out the beta version of an app designed to bring a new listening experience with the full range of audio journalism and storytelling, as well as narrated articles, podcasts, and audio content from a slate of premier publishers.

The announcement was accompanied by a request asking for participants to be a part of the beta-testing to help track the user experience. The survey questions revealed a lot about what the Times is hoping to achieve with the app, and public radio should sit up and pay close attention to where this experiment is headed as the effort to own the distribution platform to go with the content is an important play in the audio space.

In July, Three Things noted the saga that public radio has been through with attempts to build or buy its own app that could serve as a home for on-demand content. From RadioPublic to Pocket Casts to NPR One, public radio has been unable to develop enough use from these various products for a pathway to an audio subscription service that would be owned by public radio. The big advantage, of course, in owning the distribution platform is owning the data and user information.

In the survey to recruit beta-testers, the Times asks about podcast listening habits (above) and what news sources you pay to access, subscribe to, or make donations to?

Among the choices are “NPR.”

Bloomberg News, reporting on the announcement, noted that the app will feature curated Times podcasts, audio versions of articles, and the archive of “This American Life,” which the newspaper publisher licenses. It also has audio stories from other publications, such as New York Magazine, Rolling Stone, and Mother Jones, that are available on Audm, a company that narrates long-form magazine articles. The Times acquired Audm last year.

In it’s report, Boomberg quotes Sam Dolnick, an assistant managing editor at the Times, who says that for now, the goal is to package the expanding portfolio of audio content in one place so it will be easier to find and get listening recommendations.

“We hope this becomes a hub of audio journalism,” Dolnick said.

The Bloomberg reporting describes Times executives as saying they have no immediate plans to put the app behind a paywall. Still, the survey questions and some of the other strategies that the Times have instituted would lead one to think otherwise down the road.

“Right now, Times subscribers don’t have much of a relationship with audio at all,” Dolnick said. “We’ve got a lot of work to do to change that because we think that makes the Times experience that much richer.”

It’s also worth recalling that the Times did not join other producers in establishing subscriptions through Apple’s podcast app, which could have been an early indicator of the strategy they are moving toward with this app.

For public radio, this feels like a direct competitive assault that could steal time, attention, and revenue away from networks and stations.

Mark Stenberg, writing in Adweek about the announcement, notes that “in recent years, publishers have redoubled their efforts to encourage readers to consume content on their native apps. Doing so allows publishers to collect richer first-party data and more accurately track user preferences, which enables them to recommend more relevant articles and advertisements. As a result, the product becomes stickier, users return more often, and the virtuous cycle continues.”

Stenberg adds that “by consolidating its audio journalism into one place and owning its distribution, the publisher also creates a stronger direct relationship with listeners. Regular listeners will have a reliable home for their favorite audio products, while the podcast-curious will have a convenient destination to peruse all of The Times’ aural offerings.”

This is something that public radio needs to embrace rather than relying entirely on third parties like Apple or Spotify.

Stephanie Preiss, The Times’ VP of audio and TV, told Adweek that “Our strategy is to be a company that is in direct relationships with people, because we believe that’s what leads to willingness to pay.”

When it comes to audio distribution, particularly with on-demand, public radio needs to come together in a similar fashion with urgency and focus.

THING TWO: Local Ad Spending Forecasts for 2022

This past week we’ve seen a couple of forecasts on the state of local advertising and what to expect in the coming year, and neither prediction is particularly bullish on radio.

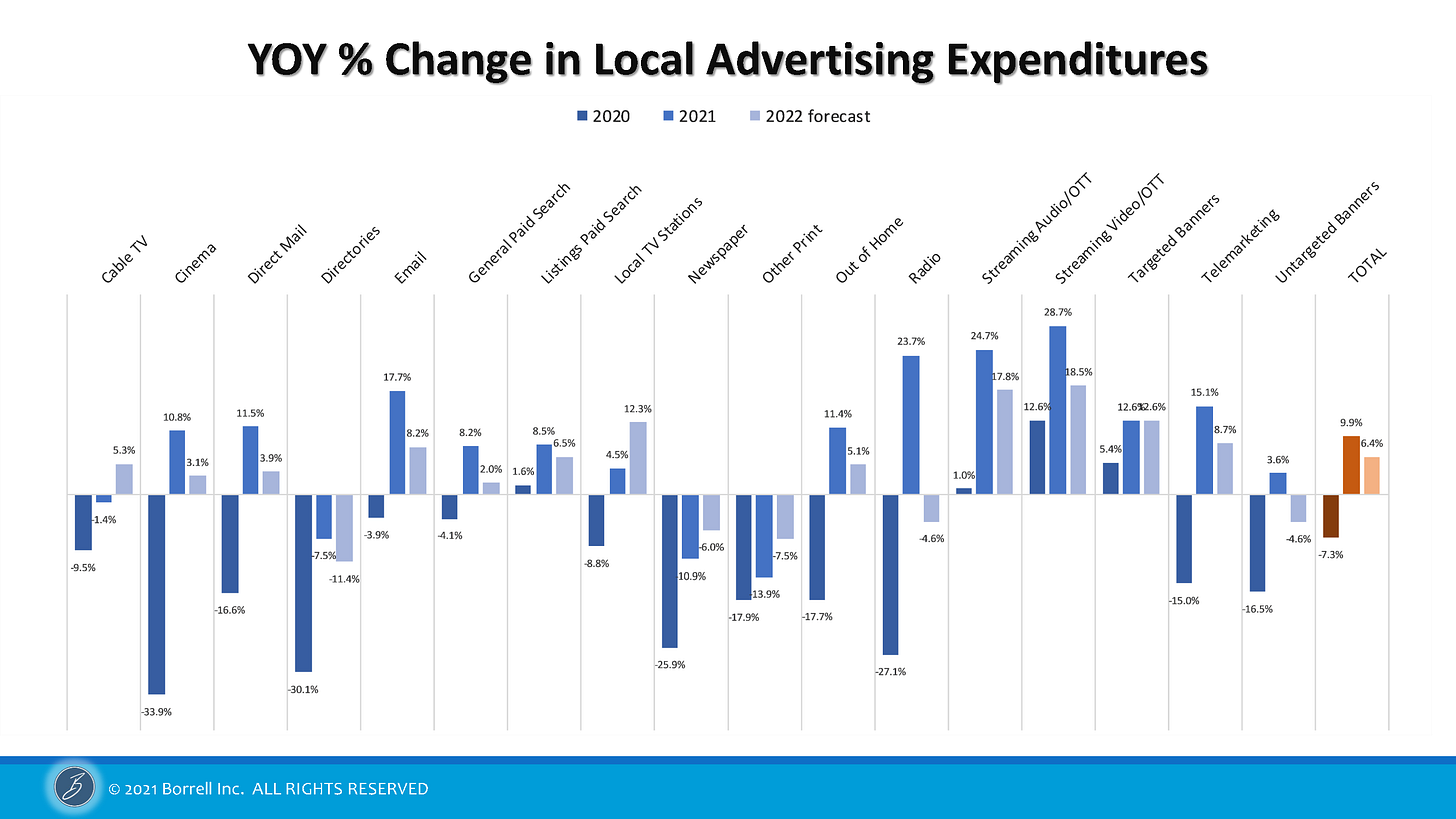

On Tuesday, Borrell hosted a webinar offering its outlook for next year, projecting a 6.4% increase in overall local advertising expenditures in 2022, with most of that increase coming in digital advertising.

The chart above tracks local advertising trends across 17 media categories from 2020 - 2022. After a solid recovery this year, radio is projected to experience negative growth (-4.6%) next year. On the bright side, streaming audio1 is predicted to grow 17.8% in 2022, following the 2021 projection of 24.7%.

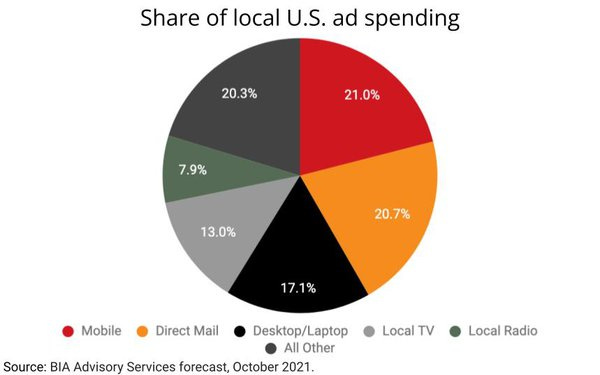

Another forecast from BIA Advisory Services has local radio advertising revenue in 2022 hitting $12.7 billion, $11 billion from over the air, and $1.7 billion from digital, according to the firm’s U.S. Local Advertising Forecast Report. That’s up from an earlier 2021 projection of $11.7 billion in total revenue for radio.

These projections show the power of digital in local advertising, particularly the dominant role that mobile will play in the future.

The Borrell forecast projects that by 2025, 72% of all U.S. advertising will be spent on digital platforms.

The presentation from the team at Borrell also provides a long view of digital advertising identifying three phases over 25 years.

Decade 1 was the focus on search, with Google leading the way. In Decade 2, social was the predominant driver of digital advertising led by Facebook. For the next ten years, the Borrell researchers are projecting the spending on streaming video will surpass search by 2025.

What’s even more interesting from the survey of local ad buyers is that this focus on online video is very much a local buy from a local media company, including radio.

While the growth in local advertising around audio looks to be with streaming audio, the presentation from the Borrell team noted that only 9% of local businesses are buying streaming audio, including podcasting, against 38% buying radio. Meanwhile, most digital audio2 buys are geo-targeted ads with national streamers or podcasters with very little spent with local outlets. Thus, an opportunity exists for local radio stations to develop audiences on digital platforms that can be sold locally.

You can view the Borrell presentation and download the slide deck from the Borrell website if you want a deeper dive into the data.

THING THREE: Deloitte’s Connectivity and Mobile Trends Survey

For most Americans, the past 19 months brought countless changes in how our lives as our homes became the center of our world, where individuals and families work, learn, and entertain themselves within the confines of our living space.

For those in public media, we’ve experienced this first-hand in how we work, but also how our audiences have adapted in the ways they use our services.

Deloitte’s Center for Technology, Media & Telecommunications fielded independent research in February–March 2021, employing an online methodology among 2,009 US consumers that revealed how the pandemic has brought about innovations in the home in how people use technology in their daily lives.

The portion of an infographic from Deloitte showing some of the results of this survey are stunning. However, when you look deeper into your personal use of technology at home, you begin to nod your head in agreement.

The average U.S. home now includes 14 different kinds of connected devices, up from 11 in 2019. These include laptops, tablets, and smartphones, video streaming devices and smart TVs, wireless headphones and earbuds, gaming consoles, smart speakers, and other smart home devices such as a smart door lock, home security system, and connected cameras. Add items like fitness trackers and connected exercise machines and you can see how quickly you can get to the average of 25 devices.

And many of these devices are used to experience media.

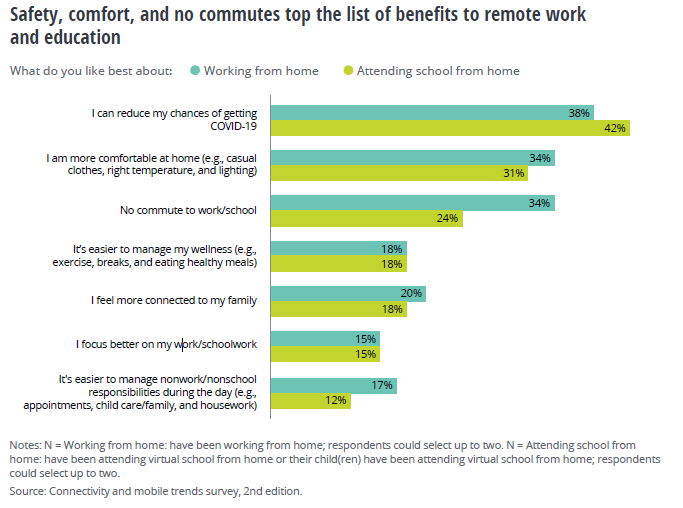

The survey also supports the well-documented research that employees are reluctant to return to pre-pandemic work routines.

The Harvard Business Review reported that more than 40% of U.S. employees would start looking for another job or quit immediately if ordered to return to the office full time.

The Deloitte research also found how the smartphone helped people shop, pay, and eat safely, as well as experience more audio, video, and text since the onset of the pandemic.

51% of people surveyed used their smartphones for in-store pickup of online purchases during the pandemic against 31% prepandemic.

70% said they would continue newly adopted smartphone behaviors after the pandemic.

Take the QR code as a further example. Ira M. Gostin with Gostin Strategic Consulting wrote a piece earlier this year in Forbes detailing how various industries are now incorporating QR codes into multiple applications that include linking to donation pages for nonprofits to a way for a person to sign up for a podcast.

For public media organizations, understanding how these technology trends fit into lifestyle changes in the “next normal” will be among dozens of strategic considerations for the industry.

The full 24-page report from Deloitte is available here.

Streaming audio includes pure-play streamers, broadcast streaming, and podcasts.

I’m using the terms streaming audio and digital audio interchangeably. Both also include podcasts.