Three Things for January 13, 2022

This week: Audio in the Media Universe. Plus the roller coaster ride of the smart speaker and Disney's Three Pillars.

THING ONE: Looking for Audio in the Media Universe

For the last several years, Evan Shapiro has published an amazing visualization detailing the media universe (the one below has a U.S. focus), providing a view of the media landscape similar to the realization of the Earth’s place in the Universe.

To help you find your way through this maze, I’m “borrowing” an idea that Fred Jacobs used in a Jacobs Media blog post last year and adding “coordinates” to the map to help you find different areas of interest.

What’s changed in this brand new edition of the media universe?

Gaming and the Creator Economy. Shapiro predicts that NVIDIA (D11) will be the next Trillion Dollar media company and is what Shapiro describes as “an emerging Death Star in the media landscape,” joining Amazon, Apple, Microsoft, Alphabet, and Meta as the mega players on the map. As a chip manufacturer, NVIDIA is bigger than Intel and has become an essential part of the gaming industry that has flourished during the pandemic. Just hone in on some of the other companies in the orbit around NVIDIA to get a sense of how big the gaming industry has grown in the past few years.

Add the gaming industry with TikTok (C10) and others in the Creator Economy, and you have a significant force in revenue and where people are spending time with media. An example in this space is the membership platform Patreon (D9) that provides business tools for content creators to run a subscription service. The company, which is not yet nine years old, produces a billion dollars more in revenue than all of public radio while generating around three million active patrons each month.

Health Media. This is a new category for Shapiro that, again, is a result of the change in lifestyles over the past two years as Anything else. For example, Shapiro notes that Peloton (D6) has transformed from a workout device maker into an exercise content subscription company. Also in this category are teleMed companies TeleDoc and Talkspace, and Shapiro is predicting this category to grow significantly in the coming years.

News and Local/Public Television. Shapiro added Buzzfeed and Vox to the news sector (C6), which is squeezed between television and video platforms. Public Television/PBS1 (C7) has been added to the map for the first time as a $3 billion industry near other local commercial TV operators (D7), including Tegna, Nexstar, Sinclair, and Gray TV.

One of Shapiro’s big predictions for the coming year is the potential for more mergers and acquisitions in the audio sector. He notes that Spotify’s (E1) market cap has been down 40% since March despite several acquisitions and investments and that Amazon is going all-in on audio (this is something to keep your eye on since they still dominate the smart speaker market too). Shapiro even speculates that Spotify, iHeart (D1), and Audacy might be bought by one of the “death stars.” He notes that Meta wants to find its way into the subscription economy, and Microsoft has been trying to buy something big focused on youth since 2020.

Oh, and NPR (meaning all of public radio) is on the map for the first time at E1 with $3 billion in revenue and squeezed in between Sirius and Spotify in the very small audio section of the map.

There’s a lot more to explore across the entire media universe. For example, the television and video platforms across the A and B sections on the map are fascinating to observe, particularly in light of how the subscription video-on-demand sector has changed that landscape over the past few years.

What I like about this visualization is that it gets you out of your bubble to truly get a sense of the vast state of the media and technology landscape. This is particularly true when you zoom out (below) to see the size, scope, and influence of the “death stars” — Amazon, Apple, Microsoft, Alphabet, NVIDIA, and Meta.

Shapiro, who teaches part-time at NYU and has run several media companies, also has a terrific newsletter that’s worth checking out.

I’m interested to know what takeaways and ideas you have in looking at the map.

THING TWO: The Smart Speaker Roller Coaster Ride

It seems that a week rarely goes by where we see signs, some good but most not so good, about the sales and use of smart speakers in the U.S.

I, for one, have held the belief for more than half a decade that the smart speaker is an essential platform for radio in maintaining its presence in homes and workplaces. However, the road to smart speakers being a universal device in the home is having some ups and downs in recent months.

Let’s start with some good news.

Last month, the Radio Research Consortium reported that public radio listeners have continued the trend of having a higher adoption of smart speakers than the general population. This is according to the latest Nielsen Scarborough USA+ study from 2021 (Release 1, January 2020 – May 2021, Adults 18+).

Twenty-nine percent of the public radio audience owned at least one smart speaker in 2021, compared with 26 percent of the U.S. population.

An increasing number of listeners choose to listen to public radio through a voice‐activated internet device rather than traditional radio. By comparison, another smart device, the Smart T.V., is now in over 40% of households (although the use of a Smart T.V. for audio is minimal at this point).

While this was good news for public radio, the trend of how consumers are using smart speakers is not so good.

A recent report from Bloomberg citing some internal Amazon documents found that Alexa users are stuck using the same tasks repeatedly for their devices. A few highlights from the report:

In 2020, Amazon determined that 25% of U.S. households have at least one Alexa device, rising to 27% for Amazon Prime customers.

Amazon’s documents also acknowledge the ongoing privacy concerns that make people suspicious of voice assistants and smart home devices as a significant impediment to more growth.

Last year, Amazon concluded that the market for smart speakers had “passed its growth phase” and estimated it would expand only 1.2 percent annually in the future.

In a planning doc from 2019, Amazon noted that Alexa users discover half of all the features they will ever use within three hours of activating a new device. There are just three main use-cases for most users: listening to audio/playing music, setting timers, and controlling lights.

Many customers buy new Alexa devices at Christmas, but keeping people engaged can be tricky. Per Bloomberg, Amazon found in some years that 15% to 25% of new Alexa devices were no longer active by just the second week of use.

On the subject of Christmas, a post-holiday report from the investor publication Benzinga spun the news that downloads for the Alexa app increased substantially right after Christmas, signaling that holiday sales for the devices were strong.

The Amazon Alexa voice app was ranked 60th in Apple’s app store at the beginning of December. It fell as low as 104th during the month before steadily trending higher, according to data from SimilarWeb. In the week after Christmas, it was ranked 10th in the "Top Free Apps" category in the Apple app store. Over the last week in December, it passed other popular apps including Walt Disney Company's Disney+, Twitter, and DoorDash.

Meanwhile, one of the promising gadgets to be introduced at last week’s Consumer Electronics Show was this new Lenovo Smart Clock Essential with Alexa Built-in. CNN named the device a Best of CES 2022.

Lenovo had been producing these devices with Google Assistant voice functionality, so the news at CES was that it added Alexa built-in.

The $59 price tag for a digital clock is a little pricey, but if a consumer wants a device for the kitchen or bedroom with a visual appeal (they currently come in two different colors) and a smart speaker, it’s pretty cool. I also think that the traditional-looking design might help overcome some consumer worries over privacy with smart speakers.

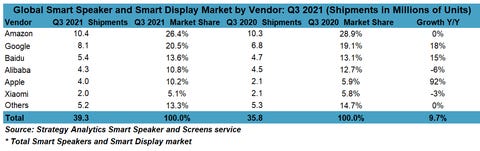

One other piece of smart speaker news to keep your eye on is the increased market share of Apple’s Home Pod mini. Apple shipped an estimated 4 million smart speaker units in the third quarter of 2021, representing 10.2% of the market, according to new data from Strategy Analytics. That’s nearly double Apple’s 5.9% market share in Q3 2020.

As the smart speaker market continues to evolve, public radio will need to continue to evaluate how much it wants to invest in promoting listening through the devices and the potential of new product offerings (i.e. skills) for smart speaker users. I would love to see a more collaborative approach across public radio to create skills that can use this platform to build loyalty beyond the “play NPR” skill and perhaps grow revenue through these devices.

THING THREE: How Public Radio Might Apply Disney’s Three “Strategic Pillars”

On Monday, The Hollywood Reporter ran a story detailing a memo from Walt Disney Co. CEO Bob Chapek to its 200,000 employees outlining three “strategic pillars” for the company as it nears its 100th anniversary in 2023.

Since this newsletter also uses the “three” theme, I found the simplicity of Chapek’s pillars in defining the company’s strategy very valuable and the clear focus of the company’s purpose across the wide range of products and platforms Disney offers to its audiences.

There are times in public media where we tend to overcomplicate our purpose while muddying the waters with language that may serve as poetic prose but may lack the directness of why we exist. These words can be incredibly inspiring; take E.B. White’s letter to the Carnegie Commission that public broadcasting should address itself to “the ideal of excellence, not the idea of acceptability,” however, it may not serve an organization well in terms of the reality of fulfilling its mission.

Let’s take a look at Chapek’s three strategic pillars for Disney and then explore what public radio’s pillars might be in the years ahead.

The first pillar is “storytelling excellence.” Chapek writes, “What makes Disney so unique is that the stories we tell mean something to people. They inspire, give hope, bring us together, illuminate the world around us, and create memories. That is Disney magic, and we must continue to set the creative bar higher and higher.” When you consider the multiple lines of business that encompass Disney, this is a clear directive to guide the company’s content strategy.

“Innovation” is the second pillar. Chapek notes that for nearly 100 years, Disney has been the world’s foremost innovative storyteller. His charge here is to explore how “new canvases like the metaverse” can be used to tell stories. He also is looking to take advantage of the “franchise ecosystem” (meaning its multiple brands and platforms) to innovate “as we seek to bring stories to life in new ways.” Inside Radio published a short piece yesterday describing how iHeart was working to “build an on-ramp to the metaverse” that’s worth a quick read on the subject of the metaverse.

The third pillar is a “relentless focus on our audience.” Here, Chapek makes it clear that “at the end of the day, our most important guide—our North Star—is the consumer.” Disney leadership recognizes that audiences are changing in how they want to experience content due to the evolution of technology and the pandemic. Disney’s CEO notes, “We must evolve with our audience, not work against them. And so we will put them at the center of every decision we make.” This audience-first approach is something I hope that all of us in public media agree should be focused on in the work that we do across the industry.

So how different would the three pillars be for a local public radio organization2?

Quite frankly, I don’t think all that much.

The first pillar is about our content and a focus on trust. Whether our service is focused on journalism, music, or both, we curate and create content for audiences that trust what they hear and read as authentic, empowering, and truthful. Just as Chapek describes “Disney magic,” public radio also has its magic and is centered around trust. That’s why the “Halo Effect” still resonates when our salespeople are out discussing corporate sponsorship opportunities with clients. That’s why millions of public radio listeners give to support our service. However, as the divisions and polarization across our nation and in our communities have increased, we must work to maintain the trust of our existing audiences while working to engage new audiences to trust what they hear and read in the same manner.

Innovation and Collaboration should be our second pillar. Where Disney can make investments around innovation, public radio must find the scale through a collaborative approach to innovate quickly to compete in the evolving digital arena. These collaborations may come within the industry, but they should also occur in the communities served by public radio all across the country. We should take advantage of the trust that audiences have in us to find ways to create new partnerships and alliances that bring us the scale to innovate in ways more significant than an individual organization can achieve on its own. Chapek’s memo to Disney employees hints at this same idea with the statement that innovation encourages “collaboration, sharing of best practices, and stimulate cross-studio ideation.”

The third pillar for public radio is an Audience-first approach. As nonprofit public media, we are first and foremost in the public service business, and we must never forget that it’s about the audience. For news organizations, that means revisiting and recommitting itself to the idea of a “culture of journalism” and what that means in an audience-first approach. For music stations, it’s a continued commitment to the community connection that many stations already have, focusing on how to deliver those experiences in the digital space. But, again, using the words of Chapek from his memo, “We must evolve with our audience, not work against them. And so we will put them at the center of every decision we make.”

I recognize that there is much more on the docket at most stations that these three pillars don’t specifically address, ranging from the imperatives of DEI, revenue, and talent. So what are your three pillars at your organization? I’d love to hear from you.

That’s it for this edition of Three Things. The Datebook for next week will be going out on Tuesday morning since most folks will be away from work on Monday in honor of the Martin Luther King, Jr. Holiday.

Thanks for reading.

PBS includes all of public television.

This thought experiment is intended to be focused on local stations/organizations, not networks.

Loved Thing Number 3 today about Disney, the three pillars and NPR

Thanks for the kind words and analysis. You make me seem smart.