Three Things for February 24, 2022

This week we look back to look forward in terms of listening to radio. Plus the equity of transparency and trust, and the boom in radio's digital sales.

As I wrap up this edition of Three Things on Wednesday night, I’m seeing the first reports that Russia has initiated a “special military operation” in eastern Ukraine. This is a moment that public radio is at its best providing its audience with calm, reasoned, timely, and thoughtful coverage. We will all be listening.

THING ONE: Where is Radio Listening Headed in 2022?

In the January 27, 2022 edition of Three Things, I shared some results from an extensive presentation by the Radio Research Consortium that looked at radio listening trends across the 45 PPM markets in the U.S.

As the January 2022 Nielsen Audio top-lines begin rolling out this week for PPM markets, I wanted to devote one more post to some of the trends from the past quarter against the previous seven quarters dating back to the before the pandemic.

Earlier this month, the RRC added a few additional slides tracking radio listening trends over the past eight quarters.

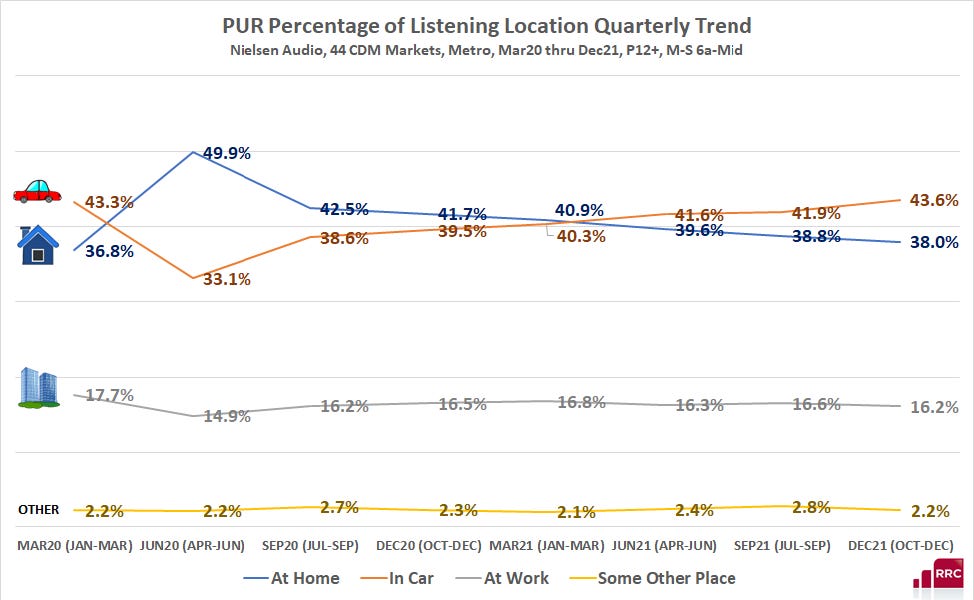

The first chart below looks at listening location trends from pre-lockdown times through the Fall 2021 quarter.

From the data, the percentage of in-car listening (43.6%) is a little more than before the lockdown.

What’s changed is that there is increased in-home listening filling the gap left by less listening taking place at work. This should not be a surprise since many employees who might previously be working on-site are still working remotely.

These are simply percentages of where the listening occurs, not the amount of listening happening to radio.

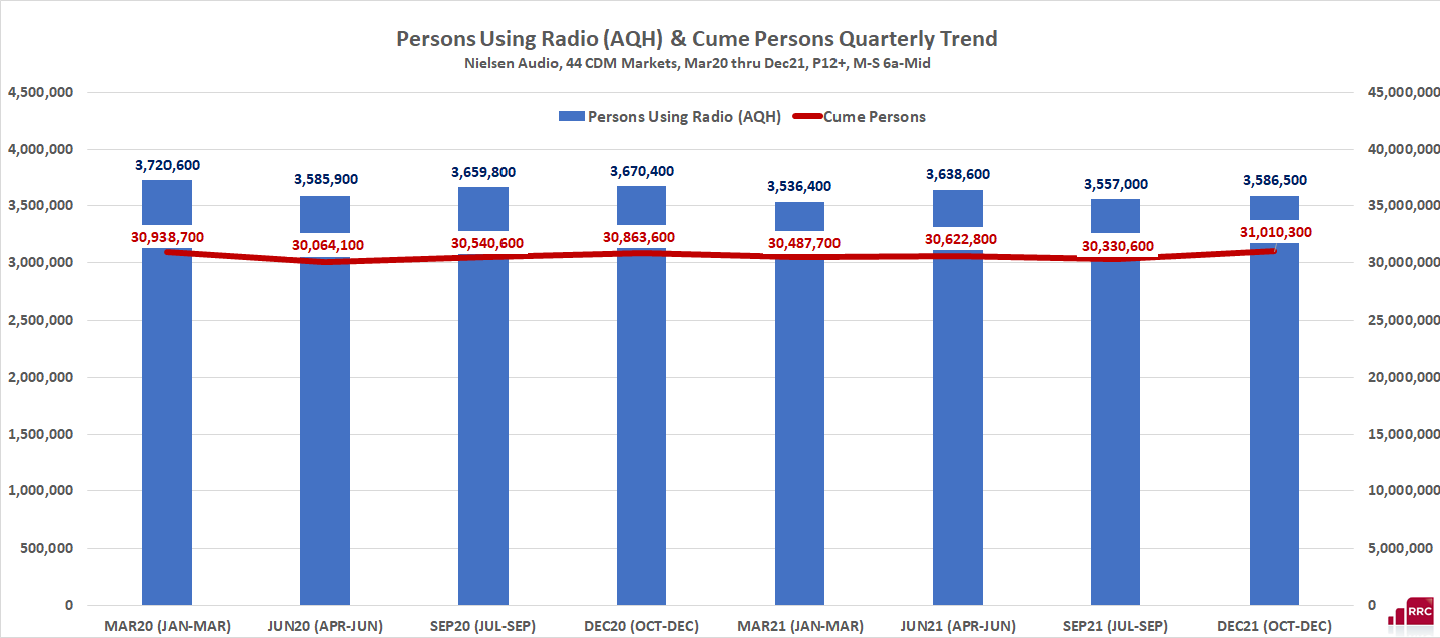

That’s where this second chart comes into play, tracking persons using radio coupled with cume audience over the same period.

The good news is that there were actually more people tuning in to radio in the Fall 2021 quarter than in Winter 2020, but they aren’t listening as much.

AQH audience is still about 4% less in the most recent quarter than before the lockdown.

This signals to me that radio is still an important part of most Americans’ lives, but they continue to find other platforms to consume media. This is much more prevalent with video and television with the explosion of streaming video options. In the specific case of audio, much of the changing consumption patterns come from the ever-increasing use of mobile devices to consume audio.

The chart below from Edison’s Share of Ear study is over a year old, but it demonstrates the impact of smartphones on audio consumption.

And according to Edison, mobile devices have already surpassed traditional radio receivers in the younger age groups. For example, among those aged 13-34, 46% of the total daily audio consumption is done on a mobile device, and 20% is done on a traditional AM/FM radio receiver.

These shifts in media consumption can’t be ignored as stations map out their content, curation, and distribution strategies to continue serving existing audiences and bringing new and more diverse audiences through digital platforms.

I plan to elaborate more on this in the weeks ahead. Still, I’d love your thoughts on whether these are the things you’re thinking about as media consumption patterns continue to evolve, particularly with younger audiences.

A few other slides from the RRC download of audience data from Fall 2021 looked at high-performing stations across public radio’s different formats.

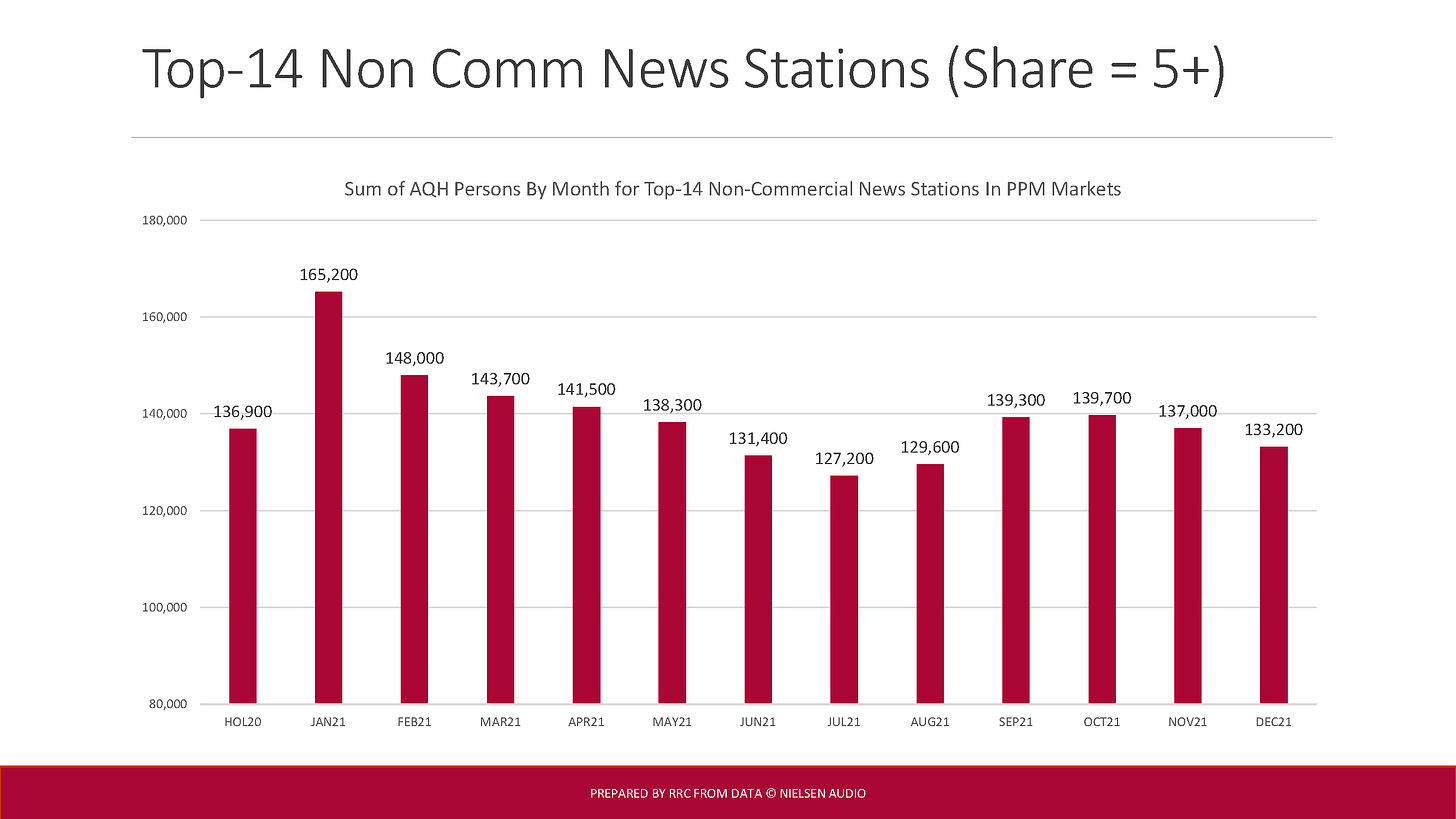

The chart below tracked the AQH of 14 public radio news stations over the past year.

After the peak in January 2021 with the January 6th Insurrection and the Inauguration of President Biden, we certainly saw the downturn and flattening of the audience over the past 11 months.

A first look at the top lines from January 2022 released this week show continued strength for stations like KQED in San Francisco and WAMU in DC, both claiming the top spot in market share in their respective markets.

The first round of releases also included a significant increase in share from WHYY in Philadelphia, jumping to a 7.4 share last month after hovering in the 4s and 5s through most of 2021. This is despite some internal challenges facing the organization. Moreover, WHYY’s year-over-year share was even better than 2021, where they were at a 6.3 share during that newsworthy month. Another noteworthy observation about WHYY is a nice jump in cume in January to more than 410,000 weekly listeners. They had been hovering in the mid-350,000s during most of 2021.

Another station with a big jump in January was WYPR in Baltimore. The station scored a 5.7 share last month, a 25% increase over January 2021, and a weekly cume of more than 183,000 listeners.

The RRC report also shared a breakdown in age composition for the different public radio formats showing a fascinating contrast between the highest performing news stations and top-performing Triple A stations.

52% of the listening to the four Triple-A stations1 used in this study are between ages 25-54 compared to the news stations2 where just 41% of the audience is within that age bracket.

Meanwhile, 64% of the listening to the top eight classical music stations3 profiled in the report are 55+, and 61% of the top six jazz stations4 audience are 55 or over.

The other chart that I found interesting was an AQH share-by-daypart breakout for each of the formats. The chart below shows the daypart share for news stations. The strength of middays from these 14 stations jumps out to me from this chart that comes close to matching PM drive.

I have to believe this is one outcome of the change in lifestyle patterns from the pandemic. Morning listening starts a little later, and more are checking in with news stations throughout the day — most likely on their phone or smart speakers.

Meanwhile, the AQH share across different dayparts for classical stations is consistent from 6 am - 7 pm, with a much larger share of listening in the evenings and on weekends. The four Triple-A stations are strongest in midday, PM Drive, and weekend.

You can download the full slide deck (77 slides!) from the RRC at this link if you haven’t done so yet.

THING TWO: The Equity of Transparency and Trust

I was recently surfing around the “Internets” seeking some inspiration for this newsletter when I stumbled across a page on the Local Independent Online News (LION) Publishers’ website. If you’re not familiar with LION, it’s a 400-plus member organization that provides training, resources, and community to local digital news outlets.

The page I’m referring to is something I’ve rarely- if ever - seen on a public media or news organization’s website. It’s something that, at least for me, signals an additional layer of transparency that I like to see from a media organization.

The page is titled “LION Publishers Staff Disclosures,” and it is precisely what it says it is in the title.

The LION Publishers staff is committed to providing our members, our board of directors, and the public with transparent disclosures on the companies and businesses we’ve worked, or currently work with, in the course of our careers. Each LION staff member must sign a conflict of interest statement to prevent the institutional or personal interests of LION Publishers staff from interfering with the performance of their duties to LION Publishers, and to ensure that there is no personal, professional or political gain at the expense of LION Publishers.

Following that statement, the text details the policy that, more than anything, signals a level of transparency from the organization’s staff to disclose any relationships that could cause some to question whether there’s a conflict of interest within the entity. The section then provided relevant disclosures from each staff member of the organization. Here’s an example:

Lisa Heyamoto is LION’s director of teaching and learning. She was a longtime senior instructor at the University of Oregon School of Journalism and Communication, and remains involved in the SOJC and the Agora Journalism Center. She is co-director of The 32 Percent Project, a community engagement initiative that explores what drives and disrupts public trust in journalism. She co-founded the initiative with her husband, who is a board member of the Energy News Network. She sits on the board of the Oregon News Enterprise, a LION member.

These disclosures are separate from the staff bios on another page of the website but exist to build trust with readers in a meaningful way. In addition, the page serves as a place to direct people should the organization’s integrity over a conflict of interest ever come up from a reader, funder, or other interested parties.

I like the idea because it adds a layer of openness and accountability that a media organization should provide to maintain the trust of its audience and the community at large.

I’m not going to fool myself to think that posting something like this on your website will garner many visitors. But if a question arises, it’s there to point to as a reference. I also think there’s value to going through this exercise with staff to ensure that everyone understands the responsibility of what working for a media/news organization entails.

This type of conflict of interest disclosure is also essential from a governance aspect. The LION webpage defines conflict of interest as an interest that might affect, or might reasonably appear to affect, the judgment or conduct of any director, officer, or staff member in a manner that is adverse to the interests of LION Publishers.

In this moment of polarization, the more steps that public media can take to be open about who we are, the more trust we can garner from our friends and detractors.

While we’re on the subject of trust, Deloitte Insights recently published a long read asking the question: “Can you measure trust within your organization?” The reason for this deep dive came out of an analysis that found examples of three large global companies, each with a market cap of more than $10 billion, that lost 20% to 56% of their value—a total $70 billion loss—when they lost their stakeholders’ trust.

Trust — or lack thereof — has thus become a mainstay topic in headlines across the world.

The piece explores the elements of trust that nearly every organization encounters, ranging from customer (audience) expectations, investor (donors) concerns over diversity and ESG5 programs, and the desire of employees to align their individual values and beliefs with their employers.

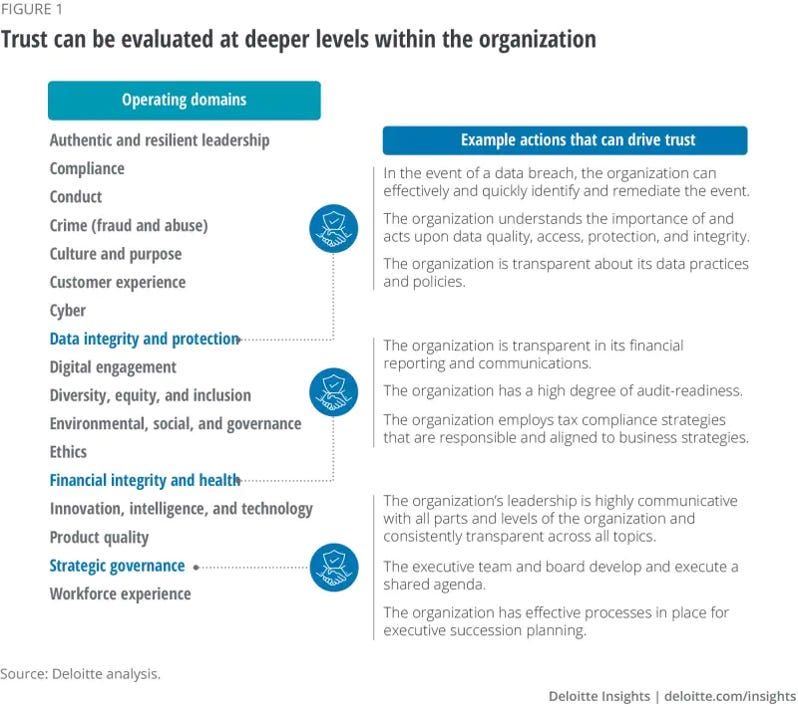

The graphic below is an example of a set of actions taken from interviews that Deloitte had with dozens of executives from Fortune 500 companies that sought to identify strategies that leaders and organizations can take to drive trust with multiple stakeholders.

As leaders in public media, the functional domains can apply to our organizations with relevant examples of actions that can drive stakeholder trust.

The piece provides some interesting case studies, but what I like about the report is a series of recommendations6 that organizations can do now to start measuring trust at more profound levels of the organization? These include:

Explore trust levels in your organization: Develop an understanding, and get an initial sense, of what trust expectations exist in the eyes of an organization’s various stakeholders. Be mindful of the fact that different groups may have different priority areas. The authors of the report recommend conducting surveys of different stakeholder groups such as employees, customers, or investors to help get a better understanding of these expectations.

Diagnose critical gaps: Leverage data, industry benchmarking studies, and output from the initial exploration phase to identify the areas within the organization that may be experiencing trust gaps.

Prioritize: It is probably not practical or feasible to address all trust gaps across the entire enterprise at one time, so leaders can prioritize focus areas by looking at the implications of each trust driver relative to the strategic priorities of the organization. Leaders can also consider how their organization compares with others within their sector or industry, or set their own goals relative to leading indicators of trust-related performance from other industries or sectors.

Activate: By focusing on the areas that are the most critical to driving trust through specific strategic initiatives, over time, organizations can see an elevation in levels of trust and the corresponding impact on stakeholder behavior.

Protect for the future, and build trust equity: Because the organization is constantly evolving as part of a complex ecosystem, trust across operating domains should be measured on an ongoing basis to anticipate and proactively address issues before they could lead to significant trust gaps. This ongoing focus on trust-building can eventually earn trust equity to aid the organization when/if negative trust events occur.

Why is all of this important? Probably the most important reason is that last paragraph. The equity we build with trust as nonprofit media organizations will sustain us. Research from the American Press Institute reinforces this idea noting that those who place a higher value on trust are more likely to interact and pay for our service.

THING THREE: 2021 Was Huge for Radio’s Digital Sales

Last week the Radio Advertising Bureau (RAB) and Gordon Borrell and Borrell Associates hosted a webinar where they shared the results of its 10th annual digital benchmarking report.

The headline of the report was pretty self-explanatory: “Finally, A Digital Bounty: Radio’s Digital Sales Rise 33%.”

The report analyzed online ad revenue from more than 3,600 radio stations. In addition, more than 1,100 local radio buyers were surveyed along with more than 250 radio managers as part of the study.

Gordon Borrell told webinar attendees that radio is “showing signs of digital normalization.” His comments noted that more stations now include a digital element in every proposal.

According to the RAB, local radio digital revenue totaled $1.5 billion in 2021, with digital sales projected to increase by 22% this year. This would bring local radio’s digital annual income to close to $2 billion.

During the webinar, Borrell commented that commercial radio sellers are moving towards the idea of digital-first. As I’ve written in past editions of Three Things, radio is showing its digital mojo when it comes to selling beyond broadcast.

This is a far cry from a few years ago when digital was just a sliver of radio’s core local revenue.

“Years of honing strategies and sales training paid off in another way as well,” the report says. “Of all local media competitors, none possessed higher rankings than radio sales reps among 2,811 advertisers surveyed in 2021.” The data shows advertisers also rate radio sellers on par with or higher than competitors for digital expertise.

The RAB survey of radio managers found that training existing sales reps on how to sell digital better has been key to this growth. In addition, the survey found that last year having more and better digital products to offer was nearly as important.

The survey did find that many stations still aren’t fully embracing podcast revenue as 44% of stations in the survey have a local podcast, yet only 20% have one that produces revenue.

The survey also found that more than a third of the stations responding were looking to add digital-only sales reps this year.

The RAB survey also found that virtual events, which came into existence mainly from the pandemic, seem to be fading as stations return to in-person gatherings. Of the stations surveyed, only 13% said they are planning virtual events this year.

How do these survey responses and the increase in digital sales compare to what’s happening in public media?

We certainly recognize the impact that podcast sponsorship has had on the national level. However, is public radio finding the same challenges at the station level as many in commercial radio?

What’s your story at your station?

That’s Three Things for this week. Thanks for reading.

A quick reminder that if you haven’t yet participated in the Staffing Vacancy Survey that the Public Impact Group is doing in partnership with Current, there’s still time to add your station info at this link. It takes about a few minutes to complete the five questions. Thanks.

The RRC study identified eight Triple-A stations with AQH shares of 2 or higher. They are KCMP -Minneapolis, KEXP -Seattle, KUTX -Austin, and WXPN -Philadelphia.

The 14 news stations with AQH shares of 5 or higher are KCFR –Denver, KCUR –Kansas City, KNOW –Minneapolis, KOPB –Portland, KPBS –San Diego, KQED –San Francisco, KUOW –Seattle, KUT –Austin, KXJZ –Sacramento, WAMU –Washington, WFYI –Indianapolis, WNPR –Hartford, WOSU –Columbus, and WUNC -Raleigh.

The eight classical stations with AQH shares of 2 or higher are KBYU -Salt Lake City, KDFC -San Francisco, KING -Seattle, KQAC -Portland, KVOD -Denver, WDAV -Charlotte, WETA -Washington, and WQXR -New York.

The six jazz stations with AQH shares of 1 or higher are KMHD -Portland, KUNV -Las Vegas, KUVO -Denver, WCLK -Atlanta, WHOV -Norfolk, and WUCF -Orlando.

I’m directly quoting these recommendations from the report written by Deloitte’s Michael Bondar, Roxana Corduneanu, and Natasha Buckley.

The news audience seems to be aging. But that might be more a reflection of who is using radio. The younger audience seems less likely to use that platform. We are not here to save radio. We are here to serve our audience no matter the platform.